Asked by Alexa Gonzalez on Apr 25, 2024

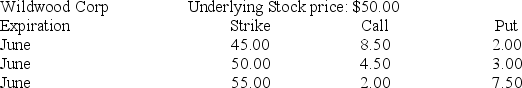

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Suppose you establish a bullish money spread with the puts. In June the stock's price turns out to be $52. Ignoring commissions, the net profit on your position is ________.

A) $500

B) $700

C) $200

D) $250

Option Quotes

Option quotes provide the price at which an option can be bought or sold, displaying details like the strike price, expiration date, and whether it's a call or put option.

Net Profit

The actual profit after working expenses not included in the calculation of gross profit have been paid.

- Identify strategies to profit from or hedge against specific market movements.

- Analyze the influence of option pricing on the success of particular profit-making strategies.

Learning Objectives

- Identify strategies to profit from or hedge against specific market movements.

- Analyze the influence of option pricing on the success of particular profit-making strategies.