Asked by joseph sciotto on May 13, 2024

Verified

When the fixed manufacturing overhead cost is recorded, which of the following entries will be made?

A) ($41,440) in the FOH Budget Variance column

B) ($41,440) in the FOH Volume Variance column

C) $41,440 in the FOH Volume Variance column

D) $41,440 in the FOH Budget Variance column

FOH Budget Variance

is the difference between the budgeted factory overhead costs and the actual overhead costs incurred.

FOH Volume Variance

A measure used in accounting to describe the difference between the budgeted and actual volume of production, affecting fixed overhead costs.

- Gain insights into the management of variances in fixed manufacturing overhead.

Verified Answer

VN

Victor NavaroMay 17, 2024

Final Answer :

B

Explanation :

Volume variance = Budgeted fixed overhead - Fixed overhead applied to work in process

= $168,000 - (18,080 hours × $7.00 per hour)

= $168,000 - ($126,560)

= $41,440 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Reference: APP10B-Ref5

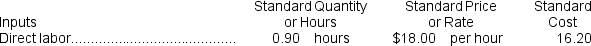

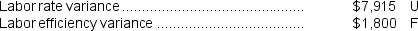

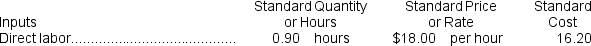

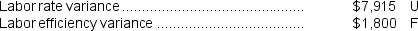

Decena Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs.Information concerning the direct labor standards for the company's only product is as follows: During the year, the company assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 15,830 hours at an average cost of $18.50 per hour.The company calculated the following direct labor variances for the year:

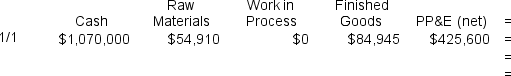

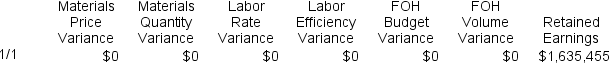

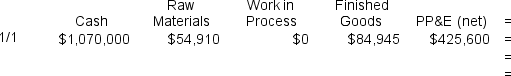

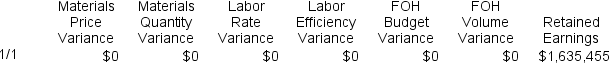

During the year, the company assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 15,830 hours at an average cost of $18.50 per hour.The company calculated the following direct labor variances for the year:  Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page.The beginning balances in each of the accounts have been given.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page.The beginning balances in each of the accounts have been given.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

= $168,000 - (18,080 hours × $7.00 per hour)

= $168,000 - ($126,560)

= $41,440 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Reference: APP10B-Ref5

Decena Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs.Information concerning the direct labor standards for the company's only product is as follows:

During the year, the company assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 15,830 hours at an average cost of $18.50 per hour.The company calculated the following direct labor variances for the year:

During the year, the company assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 15,830 hours at an average cost of $18.50 per hour.The company calculated the following direct labor variances for the year:  Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page.The beginning balances in each of the accounts have been given.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page.The beginning balances in each of the accounts have been given.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Learning Objectives

- Gain insights into the management of variances in fixed manufacturing overhead.

Related questions

Sobus Corporation Manufactures One Product ...

Azzurra Corporation Manufactures Computer Chips Used in Aircraft and Automobiles ...

Which of the Following Variances Would Be Useful in Calling ...

At the Beginning of Last Year, Monze Corporation Budgeted $600,000 ...

Reade Incorporated Makes a Single Product--An Electrical Motor Used in ...