Asked by steven remmenga on Apr 26, 2024

Verified

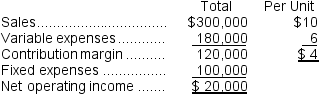

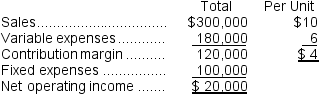

Warbler Gift's reported the following information for the sales of their single product:  Warbler's salesmen have proposed to decrease the selling price by 50 cents per unit.How many units will need to be sold for Warbler to earn at least the same net operating income?

Warbler's salesmen have proposed to decrease the selling price by 50 cents per unit.How many units will need to be sold for Warbler to earn at least the same net operating income?

A) 5,715 units

B) 36,000 units

C) 34,286 units

D) 28,572 units

Selling Price

The price at which a service or product is sold to a buyer.

Net Operating Income

The total profit of a company after subtracting operating expenses but before interest and taxes.

Operating Income

Income generated from regular business operations, excluding any investment income, taxes, or extraordinary items.

- Investigate the effects of price adjustments on the volume of sales needed to preserve or attain a preferred profitability level.

Verified Answer

TM

Traveon MurrayMay 01, 2024

Final Answer :

C

Explanation :

To solve this problem, we need to use the contribution margin formula:

Contribution Margin = Sales Price - Variable Cost

From the given information, we know that Warbler sells one product at a certain price, but we are not given the exact sales price or variable cost. We are only told that the salesmen proposed to decrease the selling price by 50 cents per unit.

Let's assume that the original sales price was $x and the variable cost was $y. With the proposed decrease of 50 cents per unit, the new sales price becomes $x - 0.5 and the contribution margin becomes ($x - 0.5) - $y.

We also know that Warbler wants to earn at least the same net operating income, which means that their total contribution margin must remain unchanged. In other words:

Original Contribution Margin x Original Units Sold = New Contribution Margin x New Units Sold

Plugging in the relevant values, we get:

(x - y) x ( ) = (x - 0.5 - y) x (New Units Sold)

) = (x - 0.5 - y) x (New Units Sold)

Simplifying this equation, we get:

(11ea7998_5e06_b92e_911b_ddc840349e95_TB2627_00_TB2627_00) = (x - 0.5 - y) x (New Units Sold) / (x - y)

We can solve for the new units sold by plugging in some values for x and y. Let's say that x = $5 and y = $3 (these are just arbitrary values). Then:

(11ea7998_5e06_b92e_911b_ddc840349e95_TB2627_00_TB2627_00) = ($4.5) x (New Units Sold) / $2

Simplifying further:

New Units Sold = (11ea7998_5e06_b92e_911b_ddc840349e95_TB2627_00_TB2627_00) x 2 / $4.5

New Units Sold ≈ 3,428.6

Rounded to the nearest whole number, this gives us a total of 3,429 units that would need to be sold to maintain Warbler's net operating income, given the proposed price decrease. Therefore, the best choice is C.

Contribution Margin = Sales Price - Variable Cost

From the given information, we know that Warbler sells one product at a certain price, but we are not given the exact sales price or variable cost. We are only told that the salesmen proposed to decrease the selling price by 50 cents per unit.

Let's assume that the original sales price was $x and the variable cost was $y. With the proposed decrease of 50 cents per unit, the new sales price becomes $x - 0.5 and the contribution margin becomes ($x - 0.5) - $y.

We also know that Warbler wants to earn at least the same net operating income, which means that their total contribution margin must remain unchanged. In other words:

Original Contribution Margin x Original Units Sold = New Contribution Margin x New Units Sold

Plugging in the relevant values, we get:

(x - y) x (

) = (x - 0.5 - y) x (New Units Sold)

) = (x - 0.5 - y) x (New Units Sold) Simplifying this equation, we get:

(11ea7998_5e06_b92e_911b_ddc840349e95_TB2627_00_TB2627_00) = (x - 0.5 - y) x (New Units Sold) / (x - y)

We can solve for the new units sold by plugging in some values for x and y. Let's say that x = $5 and y = $3 (these are just arbitrary values). Then:

(11ea7998_5e06_b92e_911b_ddc840349e95_TB2627_00_TB2627_00) = ($4.5) x (New Units Sold) / $2

Simplifying further:

New Units Sold = (11ea7998_5e06_b92e_911b_ddc840349e95_TB2627_00_TB2627_00) x 2 / $4.5

New Units Sold ≈ 3,428.6

Rounded to the nearest whole number, this gives us a total of 3,429 units that would need to be sold to maintain Warbler's net operating income, given the proposed price decrease. Therefore, the best choice is C.

Explanation :

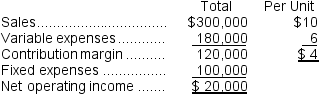

Profit = (P - V)× Q - Fixed expenses

$20,000 = ($9.50 per unit - $6.00 per unit)× Q - $100,000

($9.50 per unit - $6.00 per unit)× Q = $120,000

$3.50 per unit × Q = $120,000

Q = $120,000 ÷ $3.50 per unit

Q = 34,286 units

$20,000 = ($9.50 per unit - $6.00 per unit)× Q - $100,000

($9.50 per unit - $6.00 per unit)× Q = $120,000

$3.50 per unit × Q = $120,000

Q = $120,000 ÷ $3.50 per unit

Q = 34,286 units

Learning Objectives

- Investigate the effects of price adjustments on the volume of sales needed to preserve or attain a preferred profitability level.