Asked by Beverly Chafton on Jul 19, 2024

Verified

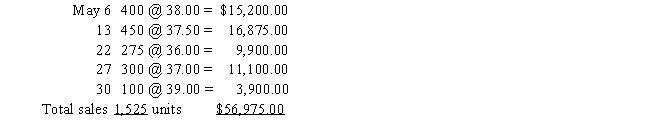

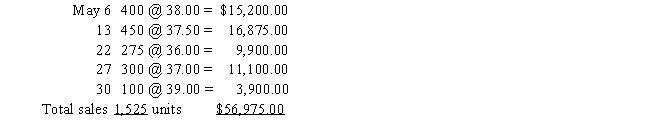

Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the average cost periodic inventory method. Round the average to the nearest cent.

A) Total sales: $56,975.00 Cost of goods sold: $36,431.25

Gross profit: $20,543.75

Ending inventory: $19,981.2

B) Total sales: $56,975.00 Cost of goods sold: $36,587.50

Gross profit: $20,387.50

Ending inventory: $19,825.00

C) Total sales: $56,975.00 Cost of goods sold: $37,312.50

Gross profit: $19,662.50

Ending inventory: $19,573.25

D) Total sales: $56,975.00 Cost of goods sold: $37,401.75

Gross profit: $19,573.25

Ending inventory: $19,010.75

Average Cost

An inventory costing method where the cost of goods sold and ending inventory is determined by taking the weighted average of all units purchased.

Periodic Inventory

A method of inventory accounting where updates to inventory levels are made periodically, often at the end of the fiscal year.

- Determine the gross profit margin utilizing distinct approaches to inventory valuation.

- Understand the application of perpetual and periodic inventory systems.

- Figure out the cost of goods sold by exploiting numerous inventory techniques.

Verified Answer

CB

Chase BrauchieJul 23, 2024

Final Answer :

D

Explanation :

Total sales (not dependent on inventory method): ?

?

Average cost periodic:

Average cost: $56,412.50/2,300 units = $24.53

Ending inventory:

775 units × $24.53 = $19,010.75

Cost of goods sold:

$56,412.50 - $19,010.75 = $37,401.75

Gross profit:

$56,975.00 - $37,401.75 = $19,573.25

Total sales (not dependent on inventory method):

?

?Average cost periodic:

Average cost: $56,412.50/2,300 units = $24.53

Ending inventory:

775 units × $24.53 = $19,010.75

Cost of goods sold:

$56,412.50 - $19,010.75 = $37,401.75

Gross profit:

$56,975.00 - $37,401.75 = $19,573.25

Learning Objectives

- Determine the gross profit margin utilizing distinct approaches to inventory valuation.

- Understand the application of perpetual and periodic inventory systems.

- Figure out the cost of goods sold by exploiting numerous inventory techniques.

Related questions

Use the Information in the Table to Answer This Question ...

Use the Information in the Table to Answer This Question ...

Using the Table Provided, Calculate Total Sales, Cost of Goods ...

What Is the Year-End Inventory Balance Using the FIFO Method ...

What Is the Year-End Inventory Balance Using the Average Cost ...