Asked by Julie Smith on Jun 18, 2024

Verified

Using a graph representing the market for loanable funds, show and explain what happens to interest rates and investment if the government budget goes from a deficit to a surplus.

Government Budget

A financial statement presenting the government's proposed revenues and spending for a financial year.

Loanable Funds

The money available for borrowing; the market wherein savers supply funds to borrowers, typically through financial intermediaries.

Interest Rates

The rate at which a borrower is charged interest for borrowing money from a lender.

- Assess the effects of state fiscal measures on interest rates and investment activities.

Verified Answer

AW

Aleea WashingtonJun 19, 2024

Final Answer :

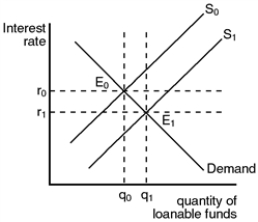

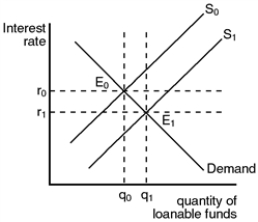

As shown in the graph below, the economy starts in equilibrium at point E0 with interest rate r0 and equilibrium quantity of saving and investment at q0. If the government succeeds in obtaining a surplus, there will be more public saving in the economy and so more national saving at each interest rate, and the supply of loanable funds curve will shift from S0 to S1. The new equilibrium will be at E1, with a lower interest rate, r1 and a higher quantity of saving and investment, q1. Hence, if the federal government succeeds in having a surplus, interest rates will fall and investment will increase.

Market for Loanable Funds

Market for Loanable Funds

Learning Objectives

- Assess the effects of state fiscal measures on interest rates and investment activities.

Related questions

Discretionary Expansionary Fiscal Policy May Not Lead to _____ ...

On a Graph That Depicts the Market for Loanable Funds ...

An Increase in the Demand for Loanable Funds Increases the ...

When the Government Budget Deficit Rises, National Saving Is Reduced ...

The Demand for Loanable Funds Comes from Saving and the ...