Asked by Tmobile Oakland on Jun 03, 2024

Verified

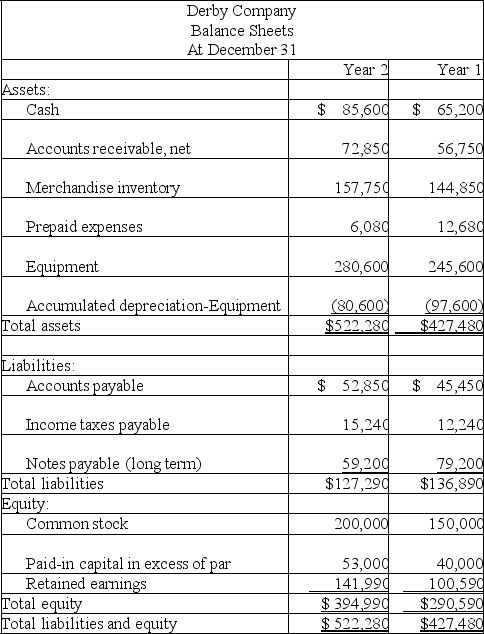

Use the following financial statements and additional information to (1)prepare a complete statement of cash flows for the year ended December 31,Year 2.The cash provided or used by operating activities should be reported using the direct method,and (2)compute the company's cash flow on total assets ratio for Year 2.

Additional Information

Additional Information

a.A $20,000 note payable is retired at its carrying value in exchange for cash.

b.The only changes affecting retained earnings are net income and cash dividends paid.

c.New equipment is acquired for $120,000 cash.

d.Received cash for the sale of equipment that had cost $85,000,yielding a gain of $4,700.

e.Prepaid expenses relate to Other Expenses on the income statement.

f.All purchases and sales of merchandise inventory are on credit.

Direct Method

A cash flow statement preparation approach that lists major operating cash receipts and payments, providing a clearer view of cash flow sources and uses.

Total Assets Ratio

A financial ratio comparing the total assets of a company to another financial metric, often used to assess a company's leverage or investment efficiency.

- Comprehend the straightforward approach for determining cash flows associated with operating activities.

- Assembling a full statement of cash flows by means of the direct method.

Verified Answer

AJ

alezandra jordanJun 08, 2024

Final Answer :

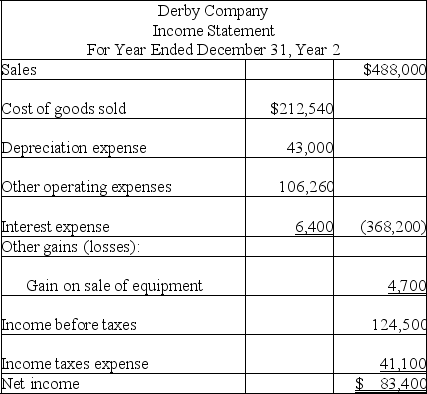

(1)

![(1) (2)$109,700/[(522,280+427,480)/2] = 23.1% (f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000 Book value of equipment sold - $85,000 cost (given)- $60,000 accumulated depreciation = $25,000 Cash from equipment sold - $25,000 book value + $4,700 gain = $29,700 (g)- Dividends paid - Beginning retained earnings $100,590 + $83,400 net income - $141,990 ending retained earnings = $42,000](https://d2lvgg3v3hfg70.cloudfront.net/TB6949/11ea83c0_ebd8_e103_b139_e13839d09c0d_TB6949_00.jpg) (2)$109,700/[(522,280+427,480)/2] = 23.1%

(2)$109,700/[(522,280+427,480)/2] = 23.1%

![(1) (2)$109,700/[(522,280+427,480)/2] = 23.1% (f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000 Book value of equipment sold - $85,000 cost (given)- $60,000 accumulated depreciation = $25,000 Cash from equipment sold - $25,000 book value + $4,700 gain = $29,700 (g)- Dividends paid - Beginning retained earnings $100,590 + $83,400 net income - $141,990 ending retained earnings = $42,000](https://d2lvgg3v3hfg70.cloudfront.net/TB6949/11ea83c0_ebd9_0814_b139_7bd45b443a0f_TB6949_00.jpg) (f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000

(f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000

Book value of equipment sold - $85,000 cost (given)- $60,000 accumulated depreciation = $25,000

Cash from equipment sold - $25,000 book value + $4,700 gain = $29,700

(g)- Dividends paid - Beginning retained earnings $100,590 + $83,400 net income - $141,990 ending retained earnings = $42,000

![(1) (2)$109,700/[(522,280+427,480)/2] = 23.1% (f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000 Book value of equipment sold - $85,000 cost (given)- $60,000 accumulated depreciation = $25,000 Cash from equipment sold - $25,000 book value + $4,700 gain = $29,700 (g)- Dividends paid - Beginning retained earnings $100,590 + $83,400 net income - $141,990 ending retained earnings = $42,000](https://d2lvgg3v3hfg70.cloudfront.net/TB6949/11ea83c0_ebd8_e103_b139_e13839d09c0d_TB6949_00.jpg) (2)$109,700/[(522,280+427,480)/2] = 23.1%

(2)$109,700/[(522,280+427,480)/2] = 23.1%![(1) (2)$109,700/[(522,280+427,480)/2] = 23.1% (f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000 Book value of equipment sold - $85,000 cost (given)- $60,000 accumulated depreciation = $25,000 Cash from equipment sold - $25,000 book value + $4,700 gain = $29,700 (g)- Dividends paid - Beginning retained earnings $100,590 + $83,400 net income - $141,990 ending retained earnings = $42,000](https://d2lvgg3v3hfg70.cloudfront.net/TB6949/11ea83c0_ebd9_0814_b139_7bd45b443a0f_TB6949_00.jpg) (f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000

(f)- Accumulated depreciation of equipment sold - beginning accumulated depreciation $97,600 + depreciation expense $43,000 - ending accumulated depreciation $80,600 = $60,000Book value of equipment sold - $85,000 cost (given)- $60,000 accumulated depreciation = $25,000

Cash from equipment sold - $25,000 book value + $4,700 gain = $29,700

(g)- Dividends paid - Beginning retained earnings $100,590 + $83,400 net income - $141,990 ending retained earnings = $42,000

Learning Objectives

- Comprehend the straightforward approach for determining cash flows associated with operating activities.

- Assembling a full statement of cash flows by means of the direct method.

Related questions

The Use of a Spreadsheet for Analysis Is Especially Useful ...

Tate Company's Current Year Income Statement and Changes in Selected ...

The Statement of Cash Flows Is Divided into Three Sections ...

Starting with Net Income and Adjusting It for Items That ...

Accounts Receivable Arising from Sales to Customers Amounted to $86000 ...