Asked by allison brockington on Jul 22, 2024

Verified

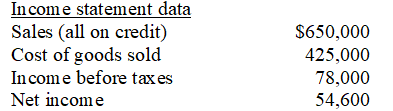

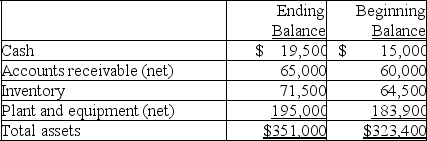

Use the financial data shown below to calculate the following ratios for the current year:

(a)Current ratio.

(b)Acid-test ratio.

(c)Accounts receivable turnover.

(d)Days' sales uncollected.

(e)Inventory turnover.

(f)Days' sales in inventory.

Acid-test Ratio

A liquidity ratio that measures a company’s ability to pay off its current liabilities with quick assets, excluding inventory.

Accounts Receivable Turnover

A financial ratio that measures the efficiency of a company in collecting its receivables or the credit it has extended to customers.

Inventory Turnover

A ratio indicating how many times a company's inventory is sold and replaced over a specific period.

- Understand and apply various financial ratios to assess a company’s liquidity, solvency, and efficiency.

- Analyze a company’s ability to turn its accounts receivable and inventory into cash, focusing on turnover ratios and days' sales outstanding.

Verified Answer

($19,500 + $65,000 + $71,500)/$62,400 = 2.5

(b)Acid-test ratio:

($19,500 + $65,000)/$62,400 = 1.35

(c)Accounts receivable turnover:

$650,000/[($65,000 + $60,000)/2] = 10.4 times

(d)Days' sales uncollected:

($65,000/$650,000)* 365 = 36.5 days

(e)Inventory turnover:

$425,000/[($71,500 + $64,500)/2] = 6.25 times

(f)Days' sales in inventory:

($71,500/$425,000)* 365 = 61.4 days

Learning Objectives

- Understand and apply various financial ratios to assess a company’s liquidity, solvency, and efficiency.

- Analyze a company’s ability to turn its accounts receivable and inventory into cash, focusing on turnover ratios and days' sales outstanding.

Related questions

The Debt Ratio,the Equity Ratio,debt-To-Equity Ratio,and Times Interest Earned Are ...

Ratios May Be Expressed as (1)________,(2)________,or (3)________

A Common Focus of Financial Statement Users in Evaluating a ...

The Following Items Are Reported on Denver Company's Balance Sheet ...

Given the Following Data:Dec ...