Asked by Cynthia Powell on Jul 24, 2024

Verified

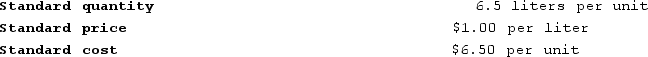

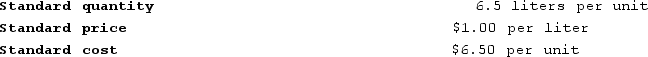

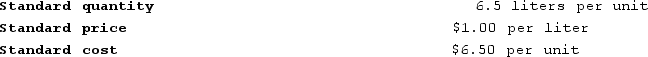

Turrubiates Corporation makes a product that uses a material with the following standards:  The company budgeted for production of 2,300 units in April, but actual production was 2,400 units. The company used 16,410 liters of direct material to produce this output. The company purchased 18,600 liters of the direct material at $1.10 per liter.The direct materials purchases variance is computed when the materials are purchased.The materials price variance for April is:

The company budgeted for production of 2,300 units in April, but actual production was 2,400 units. The company used 16,410 liters of direct material to produce this output. The company purchased 18,600 liters of the direct material at $1.10 per liter.The direct materials purchases variance is computed when the materials are purchased.The materials price variance for April is:

A) $1,860 Unfavorable

B) $1,860 Favorable

C) $1,560 Unfavorable

D) $1,560 Favorable

Materials Price Variance

The difference between the actual cost of materials and the expected (standard) cost, used for budgeting and cost control.

Actual Production

Refers to the actual quantity of goods or services produced during a specific period, as opposed to planned or projected amounts.

- Perform analysis and computation of variances in direct materials, with a focus on price and quantity.

Verified Answer

SM

Sentell MitchellJul 31, 2024

Final Answer :

A

Explanation :

Direct Materials Price Variance = (Actual Quantity Purchased × Actual Price) - (Actual Quantity Purchased × Standard Price)

Actual Quantity Purchased = 18,600 liters

Actual Price = $1.10 per liter

Standard Price = Standard cost per unit ÷ Standard quantity per unit

= ÷ 2,300 liters

÷ 2,300 liters

= $6.00 ÷ 2,300

= $0.0026 per liter

Standard Quantity for 2,400 units = 2,400 × 11eb6b8f_6347_8952_bf83_69faabdf305a_TB8314_00

= 9,600 liters

Actual Quantity Used = 16,410 liters

Direct Materials Price Variance = (18,600 × $1.10) - (18,600 × $0.0026 × 16,410)

= $20,460 - $711.16

= $19,748.84

Since the actual price paid for the material was higher than the standard price, the variance is unfavorable. Therefore, the correct answer is A) $1,860 Unfavorable.

Actual Quantity Purchased = 18,600 liters

Actual Price = $1.10 per liter

Standard Price = Standard cost per unit ÷ Standard quantity per unit

=

÷ 2,300 liters

÷ 2,300 liters= $6.00 ÷ 2,300

= $0.0026 per liter

Standard Quantity for 2,400 units = 2,400 × 11eb6b8f_6347_8952_bf83_69faabdf305a_TB8314_00

= 9,600 liters

Actual Quantity Used = 16,410 liters

Direct Materials Price Variance = (18,600 × $1.10) - (18,600 × $0.0026 × 16,410)

= $20,460 - $711.16

= $19,748.84

Since the actual price paid for the material was higher than the standard price, the variance is unfavorable. Therefore, the correct answer is A) $1,860 Unfavorable.

Learning Objectives

- Perform analysis and computation of variances in direct materials, with a focus on price and quantity.

Related questions

Gipple Corporation Makes a Product That Uses a Material with ...

Luma Incorporated Has Provided the Following Data Concerning One of ...

Gipple Corporation Makes a Product That Uses a Material with ...

The Following Materials Standards Have Been Established for a Particular ...

Solly Corporation Produces a Product for National Distribution ...