Asked by Jacek Buczko on May 10, 2024

Verified

Tom Wilson is the operations manager for BiCorp, a real estate investment firm. Tom must decide if BiCorp is to invest in a strip mall in a northeast metropolitan area. If the shopping center is highly successful, after tax profits will be $100,000 per year. Moderate success would yield an annual profit of $50,000, while the project will lose $10,000 per year if it is unsuccessful. Past experience suggests that there is a 40% chance that the project will be highly successful, a 40% chance of moderate success, and a 20% probability that the project will be unsuccessful.

a. Calculate the expected value and standard deviation of profit.

b. The project requires an $800,000 investment. If BiCorp has an 8% opportunity cost on invested funds of similar riskiness, should the project be undertaken?

Opportunity Cost

The cost of foregoing the next best alternative when making a decision.

After Tax Profits

The net income a company retains after all its tax obligations have been settled.

- Develop the ability to evaluate expected values and grasp their critical role in influencing economic choices.

- Comprehend the idea of variance and standard deviation as indicators of risk.

- Employ probabilistic approaches in analyzing real-world economic scenarios.

Verified Answer

DK

DEEPIGA K 18MBR011May 13, 2024

Final Answer :

a.Expected Value  =

=

100,000 .4 40,000

100,000 .4 40,000

50,000 .4 20,000

-10,000 .2 -2,000

_____________ = 58,000

= 58,000

Standard deviation

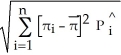

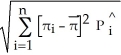

σ =

Pi

Pi

100,000 42,000 1,764,000,000 705,600,000

50,000 -8,000 64,000,000 25,600,000

-10,000 -68,000 4,624,000,000 924,800,000 = 1,656,000,000

= 1,656,000,000

σ = 40,693.98

b.Bio-Corp's opportunity cost is 8% of 800,000 or

0.08 × 800,000 = 64,000.

The expected value of the project is less than the opportunity cost. Bi-Corp should not undertake the project.

=

=

100,000 .4 40,000

100,000 .4 40,00050,000 .4 20,000

-10,000 .2 -2,000

_____________

= 58,000

= 58,000Standard deviation

σ =

Pi

Pi100,000 42,000 1,764,000,000 705,600,000

50,000 -8,000 64,000,000 25,600,000

-10,000 -68,000 4,624,000,000 924,800,000

= 1,656,000,000

= 1,656,000,000σ = 40,693.98

b.Bio-Corp's opportunity cost is 8% of 800,000 or

0.08 × 800,000 = 64,000.

The expected value of the project is less than the opportunity cost. Bi-Corp should not undertake the project.

Learning Objectives

- Develop the ability to evaluate expected values and grasp their critical role in influencing economic choices.

- Comprehend the idea of variance and standard deviation as indicators of risk.

- Employ probabilistic approaches in analyzing real-world economic scenarios.