Asked by Mayrelis Padron on Jul 05, 2024

Verified

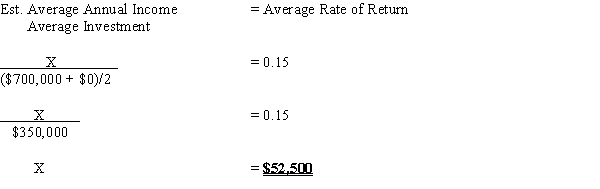

Tipper Co. is considering a 10-year project that is estimated to cost $700,000 and has no residual value. Tipper seeks to earn an average rate of return of 15% on all capital projects. Determine the necessary average annual income

(using straight-line depreciation) that must be achieved on this project for it to be acceptable to Tipper Co.

Straight-Line Depreciation

A system for spreading out the cost of a tangible asset in equal yearly amounts across its functional life.

Average Rate of Return

A financial metric used to evaluate the profitability of an investment, calculated as the average annual profit divided by the initial investment cost.

Annual Income

The total earnings or revenue generated by an individual or business in one fiscal year before any deductions.

- Estimate and clarify the average rate of profitability for investment proposals.

Verified Answer

Learning Objectives

- Estimate and clarify the average rate of profitability for investment proposals.

Related questions

A 6-Year Project Is Estimated to Cost $350,000 and Have ...

Determine the Average Rate of Return for a Project That ...

A Measure of the Average Annual Income as a Percent ...

The Annual Rate of Return Is Computed by Dividing Expected ...

The Annual Rate of Return Technique Requires Dividing a Project's ...