Asked by Elizabeth Inyang on Jul 05, 2024

Verified

The variable overhead rate variance for November is:

A) $612 U

B) $660 U

C) $660 F

D) $612 F

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the expected overhead based on standard costs.

November

The eleventh month of the Gregorian calendar, following October and preceding December.

- Understand the concept of variable overhead variances and how to calculate them.

Verified Answer

NK

Nazeli KhachatryanJul 08, 2024

Final Answer :

C

Explanation :

AH × AR = $7,590

Variable overhead rate variance = (AH × AR)? (AH × SR)

= ($7,590)? (1,650 hours × $5.00 per hour)

= $7,590 ? $8,250

= $660 F

Reference: CH09-Ref73

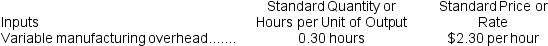

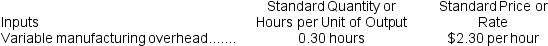

Termeer Inc.has provided the following data concerning one of the products in its standard cost system.Variable manufacturing overhead is applied to products on the basis of direct labor-hours. The company has reported the following actual results for the product for August:

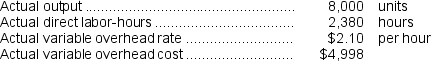

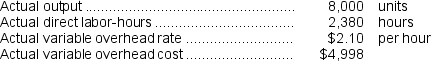

The company has reported the following actual results for the product for August:

Variable overhead rate variance = (AH × AR)? (AH × SR)

= ($7,590)? (1,650 hours × $5.00 per hour)

= $7,590 ? $8,250

= $660 F

Reference: CH09-Ref73

Termeer Inc.has provided the following data concerning one of the products in its standard cost system.Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

The company has reported the following actual results for the product for August:

The company has reported the following actual results for the product for August:

Learning Objectives

- Understand the concept of variable overhead variances and how to calculate them.

Related questions

The Variable Overhead Rate Variance for Power Is Closest To ...

What Is the Variable Overhead Rate Variance for the Month ...

The Variable Overhead Rate Variance for January Is ...

The Variable Overhead Rate Variance for Supplies Is Closest To ...

Vermeillen Corporation Uses a Standard Costing System in Which Variable ...