Asked by Ruthny Bonnet on Jul 12, 2024

Verified

The treasurer of Calico Dreams Company has accumulated the following budget information for the first two months of the coming fiscal year:  The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale. One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses. Insurance is paid in February, and property taxes are paid yearly in September. A $40,000 installment on income taxes is to be paid in April. Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are paid in March.Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $25,000.Prepare a monthly cash budget for March and April.

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale. One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses. Insurance is paid in February, and property taxes are paid yearly in September. A $40,000 installment on income taxes is to be paid in April. Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are paid in March.Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $25,000.Prepare a monthly cash budget for March and April.

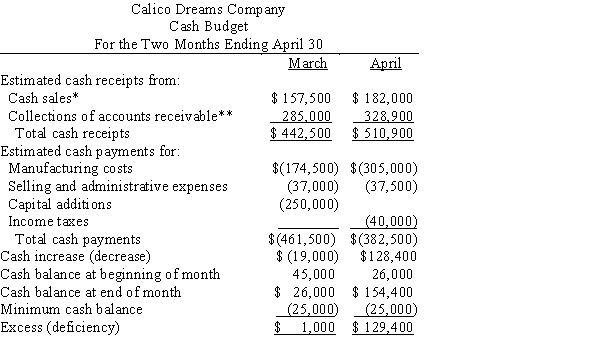

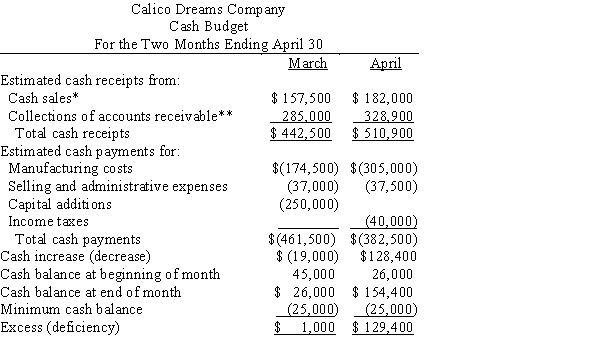

Monthly Cash Budget

A detailed plan that estimates the cash inflows and outflows for a business over a specific month, assisting in management of cash resources.

Current Liabilities

Liabilities that will be due within a short time (usually one year or less) and that are to be paid out of current assets.

Capital Additions

Expenditures made by a company to acquire or improve long-term assets to increase its efficiency or capacity.

- Acquire understanding of how to prepare a cash budget and what it entails.

Verified Answer

MM

Mukhi MitleshJul 14, 2024

Final Answer :  *$450,000 × 0.35 = $157,500

*$450,000 × 0.35 = $157,500

$520,000 × 0.35 = $182,000

**($450,000 × 0.65 × 0.80) + $51,000 = $285,000

($520,000 × 0.65 × 0.80) + ($450,000 × 0.65 × 0.20) = $328,900

*$450,000 × 0.35 = $157,500

*$450,000 × 0.35 = $157,500$520,000 × 0.35 = $182,000

**($450,000 × 0.65 × 0.80) + $51,000 = $285,000

($520,000 × 0.65 × 0.80) + ($450,000 × 0.65 × 0.20) = $328,900

Learning Objectives

- Acquire understanding of how to prepare a cash budget and what it entails.