Asked by Tristan Gebbia on Jul 03, 2024

Verified

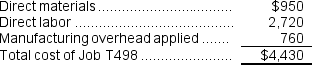

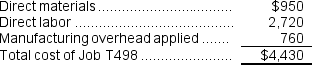

The total job cost for Job T498 is closest to:

A) $4,430

B) $3,670

C) $1,710

D) $3,480

Total Job Cost

The sum of all costs directly attributed to a specific job, including materials, labor, and overhead.

- Examine the method of attributing manufacturing overhead costs to particular job assignments.

- Comprehend the influence of manufacturing overhead costs on the job cost sheets.

Verified Answer

JG

jeremiah ganawayJul 05, 2024

Final Answer :

A

Explanation :

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base)= $497,000 + ($2.40 per direct labor-hour × 70,000 direct labor-hours)= $497,000 + $168,000 = $665,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $665,000 ÷ 70,000 direct labor-hours = $9.50 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $9.50 per direct labor-hour × 80 direct labor-hours = $760

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $665,000 ÷ 70,000 direct labor-hours = $9.50 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $9.50 per direct labor-hour × 80 direct labor-hours = $760

Learning Objectives

- Examine the method of attributing manufacturing overhead costs to particular job assignments.

- Comprehend the influence of manufacturing overhead costs on the job cost sheets.

Related questions

The Amount of Overhead Applied to Job T498 Is Closest ...

In a Normal Costing System Actual Overhead Costs Are Allocated ...

Freeman Company Uses a Predetermined Overhead Rate Based on Direct ...

Kostelnik Corporation Uses a Job-Order Costing System with a Single ...

The Amount of Overhead Applied in the Forming Department to ...