Asked by Derek Maxwell on Mar 10, 2024

Verified

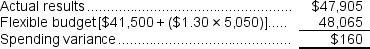

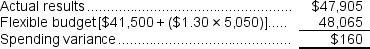

The spending variance for manufacturing overhead in May would be closest to:

A) $160 U

B) $225 U

C) $225 F

D) $160 F

A) $160 U

B) $225 U

C) $225 F

D) $160 F

Manufacturing Overhead

The indirect costs associated with manufacturing, including costs related to operating the factory that are not directly tied to the production of goods.

Spending Variance

The difference between the actual amount spent and the budgeted or planned amount in a financial plan or budget.

- Understand the concept of spending variance and how to calculate it for different categories (manufacturing overhead, refurbishing materials, other expenses, equipment depreciation, supplies costs, occupancy costs, employee salaries and wages, facility expenses, travel expenses, power cost, and medical supplies).

Verified Answer

HV

Henry Vuong

Mar 10, 2024

Final Answer :

D

Explanation :  Because the actual expense is less than the flexible budget, the variance is favorable (F).

Because the actual expense is less than the flexible budget, the variance is favorable (F).

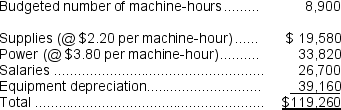

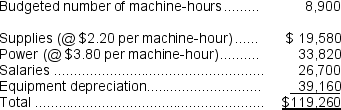

Reference: CH09-Ref29

Medlar Corporation's static planning budget for June appears below.The company bases its budgets on machine-hours. In June, the actual number of machine-hours was 9,300, the actual supplies cost was $19,760, the actual power cost was $35,720, the actual salaries cost was $27,130, and the actual equipment depreciation was $39,430.

In June, the actual number of machine-hours was 9,300, the actual supplies cost was $19,760, the actual power cost was $35,720, the actual salaries cost was $27,130, and the actual equipment depreciation was $39,430.

Because the actual expense is less than the flexible budget, the variance is favorable (F).

Because the actual expense is less than the flexible budget, the variance is favorable (F).Reference: CH09-Ref29

Medlar Corporation's static planning budget for June appears below.The company bases its budgets on machine-hours.

In June, the actual number of machine-hours was 9,300, the actual supplies cost was $19,760, the actual power cost was $35,720, the actual salaries cost was $27,130, and the actual equipment depreciation was $39,430.

In June, the actual number of machine-hours was 9,300, the actual supplies cost was $19,760, the actual power cost was $35,720, the actual salaries cost was $27,130, and the actual equipment depreciation was $39,430.

Learning Objectives

- Understand the concept of spending variance and how to calculate it for different categories (manufacturing overhead, refurbishing materials, other expenses, equipment depreciation, supplies costs, occupancy costs, employee salaries and wages, facility expenses, travel expenses, power cost, and medical supplies).

Related questions

The Spending Variance for Other Expenses for March Would Have ...

The Spending Variance for Other Expenses for October Would Have ...

The Spending Variance for Facility Expenses in March Would Be ...

The Spending Variance for Occupancy Costs for the Month Is ...

Speyer Medical Clinic Measures Its Activity in Terms of Patient-Visits ...