Asked by Delaney Bacher on May 14, 2024

Verified

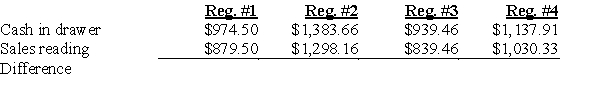

The Scharf Company is a retailer located in a state without sales tax. The following data was given to you to complete the transactions for the day's sales to be recorded. All cash drawers start with $100 in change.  Record the journal entries for EACH cash register to determine the cashier's accuracy.

Record the journal entries for EACH cash register to determine the cashier's accuracy.

Sales Tax

A consumption tax imposed by the government on sales of goods and services, collected by retailers at the point of sale and passed on to the government.

Cash Register

An electronic or mechanical device for registering and calculating transactions at a point of sale, often equipped with a cash drawer.

Cashier's Accuracy

The measure of a cashier's performance in handling transactions correctly, minimizing discrepancies between the recorded amount and the actual amount of cash received.

- Execute cash transaction journal entries and detect any inconsistencies.

Verified Answer

JS

Jessica SilvaMay 19, 2024

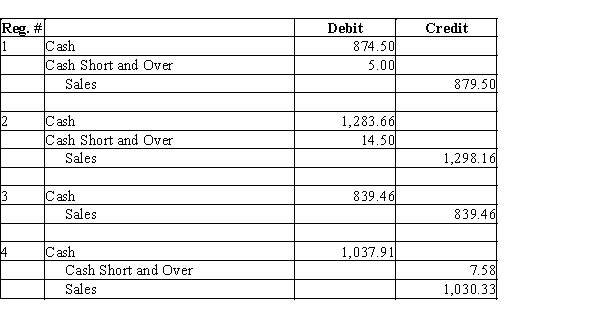

Final Answer :

Each cash drawer starts with $100. This must be subtracted from the total cash in drawer to determine the cash over/short amount.

Learning Objectives

- Execute cash transaction journal entries and detect any inconsistencies.