Asked by Nathan Labonté on Jun 04, 2024

Verified

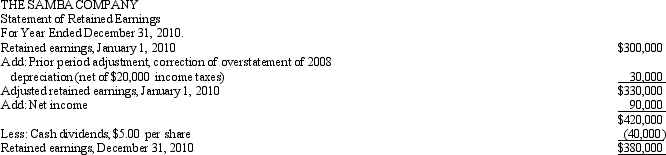

The Samba Company, during 2010, reported net income on its income statement of $90, 000.There were 8, 000 shares of common stock outstanding during the entire year, and a $5 per-share dividend was declared on November 21, 2010.During the year, it was discovered that depreciation of $50, 000 was overstated in 2008 on some production equipment.The retained earnings balance on January 1, 2010 was $300, 000, and the income tax rate on all items of income is 40%.

Required:

Prepare a retained earnings statement for the year ended December 31, 2010.

Depreciation

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence.

Retained Earnings

The portion of a company's profit that is held back and not distributed to shareholders, used for reinvestment or debt payment.

Dividend

A distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders.

- Understand and apply the concept of retained earnings adjustments and corrections of prior period errors.

Verified Answer

Learning Objectives

- Understand and apply the concept of retained earnings adjustments and corrections of prior period errors.

Related questions

The Following Information Relates to the Smith Company What Is ...

In Preparing a Statement of Retained Earnings, a Company Needs ...

The Amount of a Corporation's Retained Earnings That Has Been ...

Which of the Following Is Not Correct ...

The Correction of an Error Causes Previous Year Financial Statements ...