Asked by Rojita Malla on Apr 30, 2024

Verified

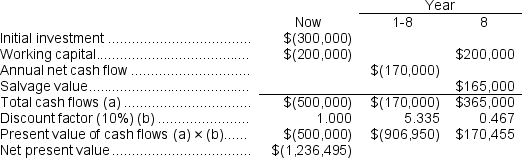

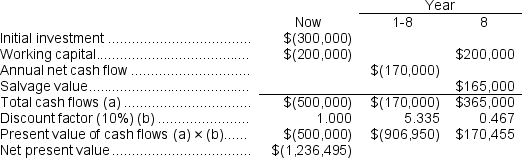

The net present value of the alternative of purchasing the new system is closest to:

A) $(1,076,495)

B) $(1,236,495)

C) $(1,169,895)

D) $(969,895)

Purchasing

The process of acquiring goods or services to accomplish the goals of an organization, often involving activities such as selection, negotiation, and order placement.

New System

A newly implemented set of procedures, technologies, or methodologies designed to change or improve current operational processes.

- Calculate the net present value (NPV) of an investment to gauge its monetary viability.

Verified Answer

ZK

Zybrea KnightMay 05, 2024

Final Answer :

B

Explanation :  Reference: CH12-Ref8

Reference: CH12-Ref8

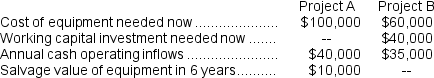

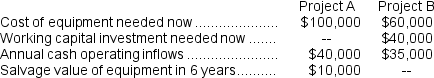

(Ignore income taxes in this problem.)Lambert Manufacturing has $100,000 to invest in either Project A or Project B.The following data are available on these projects: Both projects will have a useful life of 6 years and the total cost approach to net present value analysis.At the end of 6 years, the working capital investment will be released for use elsewhere.Lambert's required rate of return is 14%.

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis.At the end of 6 years, the working capital investment will be released for use elsewhere.Lambert's required rate of return is 14%.

Reference: CH12-Ref8

Reference: CH12-Ref8(Ignore income taxes in this problem.)Lambert Manufacturing has $100,000 to invest in either Project A or Project B.The following data are available on these projects:

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis.At the end of 6 years, the working capital investment will be released for use elsewhere.Lambert's required rate of return is 14%.

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis.At the end of 6 years, the working capital investment will be released for use elsewhere.Lambert's required rate of return is 14%.

Learning Objectives

- Calculate the net present value (NPV) of an investment to gauge its monetary viability.