Asked by Santosh Poudel on Jun 20, 2024

Verified

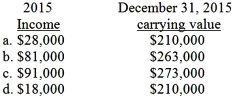

The market value of the Lite stock investment at the end of 2015 was $210,000.Which of the following amounts are correct assuming that Como elected to use the fair value option to account for the Lite investment?

A) Option A

B) Option B

C) Option C

D) Option D

Market Value

The current price at which an asset or service can be bought or sold in the marketplace.

Fair Value Option

The Fair Value Option is an accounting option that allows companies to measure selected financial assets and liabilities at fair value, aiming to provide more relevant financial information.

- Discuss the ramifications of opting for the fair value option in the accounting of equity method investments and the prerequisites for the impairment of goodwill.

Verified Answer

SP

stephanie petithommeJun 21, 2024

Final Answer :

A

Explanation :

$28,000 = $10,000 {unrealized gain: $210,000(fair value)- $200,000 (original cost)+ $18,000 (dividend income: $40,000 × 45%)} $210,000 = fair value

Learning Objectives

- Discuss the ramifications of opting for the fair value option in the accounting of equity method investments and the prerequisites for the impairment of goodwill.