Asked by Caroline Bachus on May 10, 2024

Verified

The Jessie Company acquired a competitor company in January 2010.When Jessie's accountant recorded the purchase, she correctly recorded an amount for goodwill based on the expectation of the acquired company's earning a rate of return on its assets that was in excess of the industry's rate of return.In fact, the acquired company doubled the expected rate of return in 2010 and 2011.As a result of these increased earnings, in early 2012 the president of the Jessie Company asked the company's accountant to increase the amount recognized as goodwill.

Required:

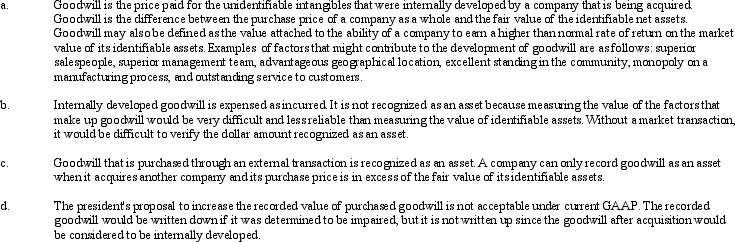

Goodwill

An intangible asset that arises when a business is purchased for more than the fair value of its net identifiable assets.

Rate of Return

A measure of the profitability of an investment expressed as a percentage of the original investment.

- Differentiate between GAAP and IFRS treatments of goodwill, including impairment and amortization.

- Analyze the accounting treatment for purchased intangible assets, including patents and goodwill.

Verified Answer

AM

Learning Objectives

- Differentiate between GAAP and IFRS treatments of goodwill, including impairment and amortization.

- Analyze the accounting treatment for purchased intangible assets, including patents and goodwill.

Related questions

An Argument in Favor of Capitalizing Purchased Goodwill Is That ...

The Jared Corporation Is Contemplating the Acquisition of the Jonathan ...

Which of the Following Is Not True Regarding the Accounting ...

Smith Corporation Is Interested in Acquiring Dawson Company and Has \( ...

Which of the Following Is an Intangible Asset That Is ...