Asked by Salvador Ramirez on Apr 30, 2024

Verified

The income statement of Frank Company is shown below: FRANK COMPANY Income Statement For the Year Ended December 31, 2017 Sales$8,400,000 Cost of goods sold5,400,000 Gross profit3,000,000 Operating expenses Selling expenses $500,000 Administrative expense 700,000 Depreciation expense 90,000 Amortization expense 30,0001,320,000 Net income $1,680,000\begin{array}{c}\text {FRANK COMPANY}\\\text { Income Statement}\\\text { For the Year Ended December 31, 2017}\\\\\begin{array}{lr}\text { Sales}&&\$8,400,000\\\text { Cost of goods sold}&&5,400,000\\\text { Gross profit}&&3,000,000\\\text { Operating expenses}\\\text { Selling expenses } & \$ 500,000 \\\text { Administrative expense } & 700,000 \\\text { Depreciation expense } & 90,000 \\\text { Amortization expense } & 30,000&1,320,000 \\\text { Net income }&&\$1,680,000\end{array}\end{array}FRANK COMPANY Income Statement For the Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses Selling expenses Administrative expense Depreciation expense Amortization expense Net income $500,000700,00090,00030,000$8,400,0005,400,0003,000,0001,320,000$1,680,000 Additional information:

1. Accounts receivable increased $400000 during the year.

2. Inventory increased $250000 during the year.

3. Prepaid expenses increased $200000 during the year.

4. Accounts payable to merchandise suppliers increased $100000 during the year.

5. Accrued expenses payable increased $160000 during the year.

Instructions

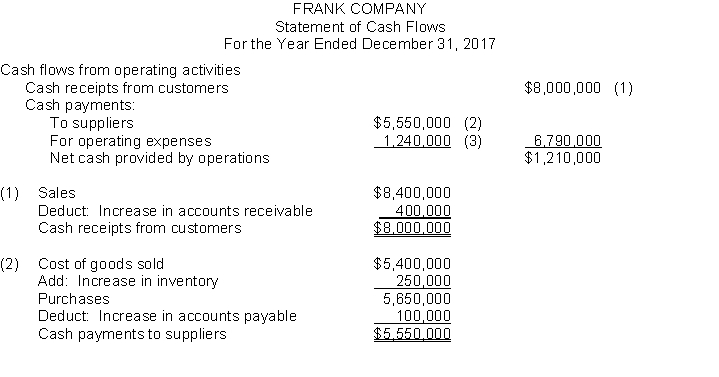

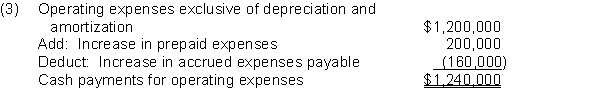

Prepare the operating activities section of the statement of cash flows for the year ended December 31 2017 for Frank Company using the direct method.

Direct Method

A way of preparing cash flow statements where actual cash inflows and outflows from operational activities are listed.

Selling Expenses

Costs incurred directly and indirectly in making sales, including commissions, advertising, and salaries of sales staff.

Administrative Expense

Overhead or general expenses related to the day-to-day running of a business but not directly tied to production.

- Estimate the financial transactions tied to the conduct of operating activities.

Verified Answer

Learning Objectives

- Estimate the financial transactions tied to the conduct of operating activities.

Related questions

Dense Company's Income Statement Showed Revenues of $275000 and Operating ...

Clare Company Had Total Operating Expenses of $185000 in 2016 ...

In Computing Cash Payments for Operating Expenses a Decrease in ...

The Income Statement for Jones Company Showed Cost of Goods ...

The General Ledger of Link Company Provides the Following Information ...