Asked by Faith Fanning on Jul 04, 2024

Verified

The IFRS disallow the use of LIFO for external financial reporting.Assume a U.S.based company has been using LIFO for financial and tax reporting but now wants to prepare IFRS conforming financial statements to enable its stock to be traded on one of the European stock exchanges.

Required:

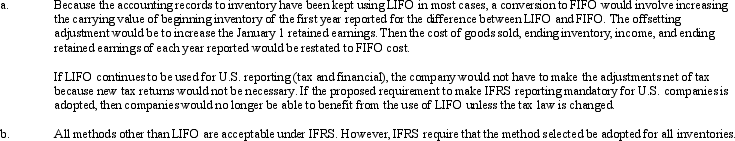

a. Describe the adjustments that the US.-based company must make to its accounting records to conform with IFRS.

b. What choices of invent ony accounting metho ds would be available to the U.S. company uncler IFRS?

IFRS

International Financial Reporting Standards, which are a set of global accounting standards.

LIFO

Last-In, First-Out method, an inventory valuation technique where the latest items added to inventory are the first ones to be used or sold.

External Financial Reporting

The process of disclosing financial information to external stakeholders, such as investors or regulators, through reports like balance sheets and income statements.

- Examine and differentiate the inventory accounting practices under IFRS and GAAP.

- Analyze the conceptual underpinnings and real-world considerations involved in selecting inventory valuation approaches.

Verified Answer

Learning Objectives

- Examine and differentiate the inventory accounting practices under IFRS and GAAP.

- Analyze the conceptual underpinnings and real-world considerations involved in selecting inventory valuation approaches.

Related questions

There Are Many Different Methods Available for Costing Inventory ...

IFRS Do Not Allow the Use of LIFO Because It ...

GAAP's Provision for Ownership of Goods (Goods-In-Transit or Consigned Goods) \(\begin{array} ...

GAAP's Definition for Inventory and Provision of Guidelines for Inventory ...

Which of the Following Are the Same Under Both GAAP ...