Asked by Nathan Papke on May 21, 2024

Verified

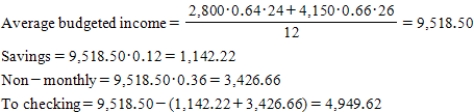

The Grangers manage their money by using a monthly budget.Mr.Granger's semi-monthly salary is $2,800,and Mrs.Granger's biweekly salary is $4,150.Mr.Granger's net income of approximately 64% of his salary is deposited in their savings account each paycheck,whereas Mrs.Granger sees 66% of her salary deposited into their savings account.How much money should the Grangers transfer from their savings to checking to cover their monthly expenses if their goal is to leave 12% of budgeted income in savings and an additional 36% of budgeted income to cover non-monthly expenses (i.e. ,water,insurance,property taxes,vacations,Christmas,charitable giving,home maintenance,etc. )?

Monthly Budget

A financial plan that allocates expected income towards expenses, savings, and debt repayment on a monthly basis.

Net Income

The amount of income that remains after deducting all expenses, taxes, and costs from gross income.

Savings Account

An account in which the bank pays interest for the use of the money deposited in the account.

- Acquire knowledge on budgeting techniques and enhance your ability to manage personal finances efficiently.

- Comprehend the methods of planning and analyzing future financial expenditures and savings employing budgetary instruments such as cash flow analysis.

Verified Answer

NM

Learning Objectives

- Acquire knowledge on budgeting techniques and enhance your ability to manage personal finances efficiently.

- Comprehend the methods of planning and analyzing future financial expenditures and savings employing budgetary instruments such as cash flow analysis.