Asked by Tyasia Lynah on Jun 05, 2024

Verified

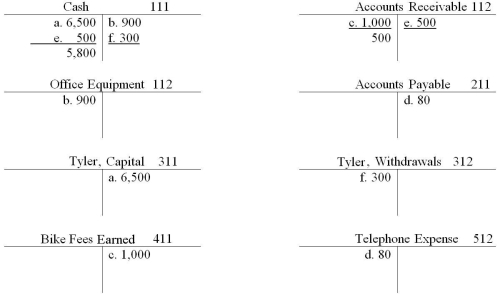

The following transactions occurred during June for Center City Cycle Shop. Record the transactions below in the T accounts. Place the letter of the transaction next to the entry. Foot and calculate the ending balances of the T accounts where appropriate.

a. invested $6500 in the bike service from his personal savings account.

b. Bought office equipment for cash, $900.

c. Performed bike service for a customer on account, $1,000.

d. Company cell phone bill received, but not paid, $80.

e. Collected $500 from customer in transaction c.

f. withdrew $300 for personal use.

T Accounts

A visual representation used in accounting to depict debits and credits for a particular account, where one side represents debit entries and the other side represents credit entries.

Transactions

Financial events that affect the financial position of a company, involving the transfer of value between two or more entities.

- Accurately record transactions in T accounts.

Verified Answer

VD

Learning Objectives

- Accurately record transactions in T accounts.