Asked by Alicia Gregory on Jul 05, 2024

Verified

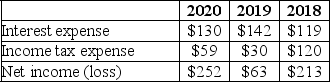

The following information was taken from the income statement of Tommy Toys for the years 2018 through 2020 (in millions):

A.Compute Tommy Toys times interest earned ratio for all three years.Round your answers to two decimal places.

A.Compute Tommy Toys times interest earned ratio for all three years.Round your answers to two decimal places.

B.Briefly interpret the times interest earned ratio for the three years.

Income Statement

A financial report that shows a company's financial performance over a specific period, detailing revenues, expenses, and net income.

Interpret

To explain or provide the meaning of something, often involving analysis of data or information to derive understanding or conclusions.

Years

A unit of time used in various financial calculations, such as the amortization of assets or the term of investments.

- Examine the importance of the debt-to-equity ratio in evaluating a company's financing and risk levels.

Verified Answer

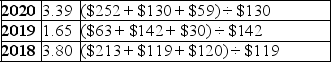

A.

B.In 2019,Tommy Toys had lower earnings and a higher amount of interest expense generated in that year.As a result,the ratio reported is lower than in the other two years examined.However,the ratio was stronger in both 2018 and 2020 indicating sufficient earnings to cover interest expense on the strength of improved earnings.It would be more important to assess the cash flow from operations to determine if Tommy Toys has the cash to pay the interest.

B.In 2019,Tommy Toys had lower earnings and a higher amount of interest expense generated in that year.As a result,the ratio reported is lower than in the other two years examined.However,the ratio was stronger in both 2018 and 2020 indicating sufficient earnings to cover interest expense on the strength of improved earnings.It would be more important to assess the cash flow from operations to determine if Tommy Toys has the cash to pay the interest.

Learning Objectives

- Examine the importance of the debt-to-equity ratio in evaluating a company's financing and risk levels.

Related questions

Which of the Following Statements Regarding the Debt-To-Equity Ratio Is ...

The Debt-To-Equity Ratio Is Calculated by Dividing Stockholders' Equity Attributable ...

A Company Has Total Assets of $350,000 and Total Liabilities ...

The Use of Debt Financing Insures an Increase in Return ...

A Company's Total Liabilities Divided by Its Total Stockholders' Equity ...