Asked by Caroline Moore on Jul 04, 2024

Verified

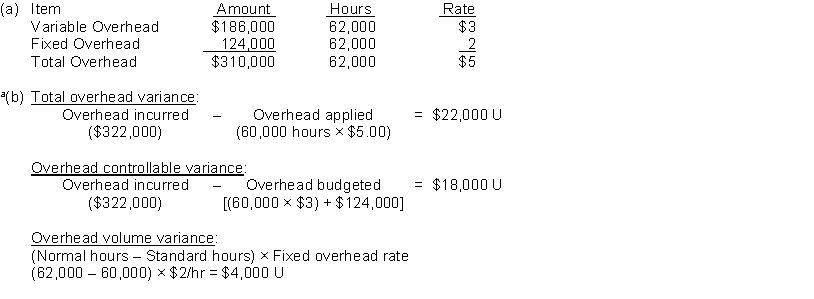

The following information was taken from the annual manufacturing overhead cost budget of Cinnamon Manufacturing: Variable manufacturing overhead costs $186,000 Fixed manufacturing overhead costs $124,000 Normal production level in direct labor hours 62,000 Normal production level in units 31,000\begin{array}{lr}\text { Variable manufacturing overhead costs } & \$ 186,000 \\\text { Fixed manufacturing overhead costs } & \$ 124,000 \\\text { Normal production level in direct labor hours } & 62,000 \\\text { Normal production level in units } & 31,000\end{array} Variable manufacturing overhead costs Fixed manufacturing overhead costs Normal production level in direct labor hours Normal production level in units $186,000$124,00062,00031,000 During the year 30000 units were produced 64000 hours were worked and the actual manufacturing overhead costs were $322000. The actual fixed manufacturing overhead costs did not deviate from the budgeted fixed manufacturing overhead costs. Overhead is applied on the basis of direct labor hours.

Instructions

(a) Compute the total fixed and variable predetermined manufacturing overhead rates.

(b) Compute the total controllable and volume overhead variances.

Predetermined Manufacturing Overhead Rates

A rate used to allocate manufacturing overhead costs to products based on a standard cost, established in advance of production.

Total Controllable

Relates to the expenses or costs over which a manager or business has direct control.

Volume Overhead Variances

The differences between the expected fixed overhead costs and the actual fixed overhead allocated, based on the volume of production.

- Gain insight into the process for figuring out factory overhead rates and multiple overhead variances.

- Establish the normative pricing for materials in manufacturing and accompanying overhead expenses.

Verified Answer

Learning Objectives

- Gain insight into the process for figuring out factory overhead rates and multiple overhead variances.

- Establish the normative pricing for materials in manufacturing and accompanying overhead expenses.

Related questions

The Overhead ______________ Variance Is the Difference Between Normal Capacity ...

Monte Industries Has a Standard Costing System ...

Total Overhead Variance. (B) Prepare the Journal Entries to Record ...

Jackson Manufacturing Planned to Produce 20000 Units of Product and ...

The Fixed Factory Overhead Volume Variance Is