Asked by Sewisha Thabo Lehong on Apr 28, 2024

Verified

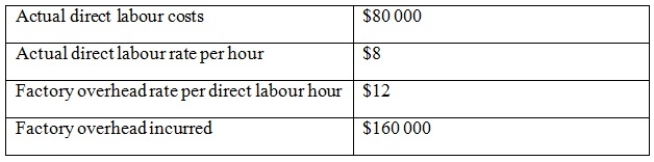

The following information relates to Wells Fargo for July 2008:

Assuming underapplied or overapplied overhead is transferred to cost of goods sold at the end of the period, which of the following would be the entry to the cost of goods sold account?

A) $80 000 debit

B) $80 000 credit

C) $40 000 credit

D) $40 000 debit

Underapplied Overhead

A situation where the allocated overhead costs are less than the actual overhead costs incurred.

Cost of Goods Sold

The total cost directly associated with producing the goods that have been sold during a specific period.

Period End

The conclusion of an accounting period, at which time financial statements are prepared and financial activities are summarized.

- Comprehend the fundamentals of manufacturing overhead that is either underapplied or overapplied and the methods for correcting such discrepancies.

Verified Answer

Learning Objectives

- Comprehend the fundamentals of manufacturing overhead that is either underapplied or overapplied and the methods for correcting such discrepancies.

Related questions

When Underapplied or Overapplied Manufacturing Overhead Is Prorated, to Which ...

If a Manufacturing Firm Ends the Year with Underapplied Overhead ...

Which of the Following Would Appear on the Credit Side ...

If Manufacturing Overhead Has a Credit Balance at the End ...

If Manufacturing Overhead Has Been Underapplied During the Year the ...