Asked by Marella Paine on Jun 19, 2024

Verified

The following information pertains to the capital structure of a firm:

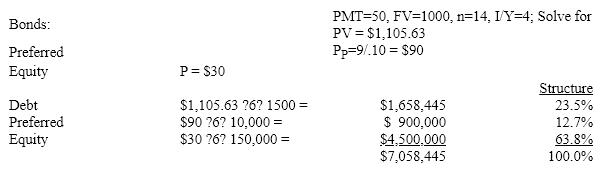

Debt : Fifteen hundred bonds with face values of $1000 and a 10-year term were issued three years ago with a coupon rate of 10% paid semiannually. Today the bonds are selling to yield 8%.

Preferred stock : Ten thousand shares of preferred stock are outstanding with a $9 annual dividend and a $100 face value. Today the shares are selling to yield a 10% return.

Common equity : 150 thousand shares of common stock are outstanding at a current market price of $30 per share.

Develop the firm's market value based capital structure.

Capital Structure

The particular combination of debt and equity that a company uses to finance its overall operations and growth.

Coupon Rate

The annual interest rate paid on a bond, expressed as a percentage of the face value.

Market Price

The current price at which an asset or service is bought or sold in the marketplace.

- Assess the corporate capital structure through market values to ascertain its Weighted Average Cost of Capital.

Verified Answer

RC

Learning Objectives

- Assess the corporate capital structure through market values to ascertain its Weighted Average Cost of Capital.

Related questions

Market Values Are Appropriate Because New Projects Are Generally Funded ...

The Valentine Company Has the Following Capital Accounts Stated at ...

Your Firm Has Earnings Before Interest and Taxes of $210,000 ...

When a Firm Is Operating at Its Target Capital Structure ...

When a Firm Is Operating at Its Target Capital Structure ...