Asked by Tladi Kelefile karabelo on Apr 25, 2024

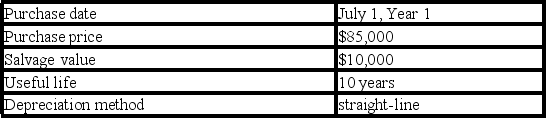

The following information is available on a depreciable asset owned by Mutual Savings Bank:  The asset's book value is $70,000 on July 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on July 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

A) $8,125.00

B) $7,375.00

C) $4,062.50

D) $3,750.00

E) $7,812.50

Depreciation Expense

Depreciation expense refers to the allocation of the cost of a tangible asset over its useful life, representing how much of the asset's value has been used up during a financial period.

Salvage Value

The estimated residual value of an asset at the end of its useful life, determining how much the asset can be sold for.

Book Value

The book value of an asset is its original cost minus any accumulated depreciation, representing its recorded value in the financial statements.

- Compute the costs of depreciation utilizing various methodologies, accounting for alterations in asset assessments, such as salvage value and useful life.

Learning Objectives

- Compute the costs of depreciation utilizing various methodologies, accounting for alterations in asset assessments, such as salvage value and useful life.

Related questions

A Company Used Straight-Line Depreciation for an Item of Equipment ...

Determine the Machines' First Year Depreciation Under the Units-Of-Production Method

Determine the Machines' First Year Depreciation Under the Straight-Line Method

What Journal Entry Would Be Needed to Record the Machines ...

What Journal Entry Would Be Needed to Record the Machines ...