Asked by Griffin Skubish on Jun 01, 2024

Verified

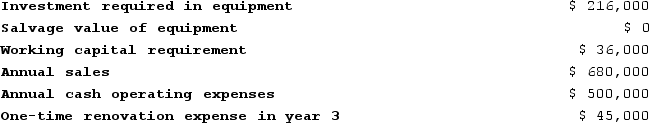

The following information concerning a proposed capital budgeting project has been provided by Jochum Corporation:Click here to viewExhibit 14B-1 to determine the appropriate discount factor(s) using tables.  The expected life of the project is 4 years. The income tax rate is 30%. The after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $54,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

The expected life of the project is 4 years. The income tax rate is 30%. The after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $54,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

A) $140,038

B) $321,300

C) $180,471

D) $285,750

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life uniformly.

- Acquire and utilize knowledge of net present value for the analysis of investment projects.

Verified Answer

JP

Julia PedalinoJun 07, 2024

Final Answer :

C

Explanation :

To calculate the net present value of the project, we need to calculate the present value of all cash inflows and outflows.

Year 0:

Initial investment = -$480,000

Year 1:

Cash inflow = $188,000

Depreciation = $54,000

Taxable income = $134,000

Tax expense = -$40,200

After-tax cash inflow = $147,800

Present value of after-tax cash inflow = $132,143

Year 2:

Cash inflow = $225,000

Depreciation = $54,000

Taxable income = $171,000

Tax expense = -$51,300

After-tax cash inflow = $173,700

Present value of after-tax cash inflow = $142,453

Year 3:

Cash inflow = $272,000

Depreciation = $54,000

Taxable income = $218,000

Tax expense = -$65,400

After-tax cash inflow = $206,600

Present value of after-tax cash inflow = $153,782

Year 4:

Cash inflow = $316,000

Depreciation = $54,000

Taxable income = $262,000

Tax expense = -$78,600

After-tax cash inflow = $237,400

Present value of after-tax cash inflow = $162,093

To calculate the net present value, we add up the present values of all cash inflows and outflows:

NPV = Present value of cash inflows - Initial investment

NPV = $132,143 + $142,453 + $153,782 + $162,093 - $480,000

NPV = $110,471

Since the NPV is positive, accepting the project would increase the value of the company. The closest answer is C) $180,471.

Year 0:

Initial investment = -$480,000

Year 1:

Cash inflow = $188,000

Depreciation = $54,000

Taxable income = $134,000

Tax expense = -$40,200

After-tax cash inflow = $147,800

Present value of after-tax cash inflow = $132,143

Year 2:

Cash inflow = $225,000

Depreciation = $54,000

Taxable income = $171,000

Tax expense = -$51,300

After-tax cash inflow = $173,700

Present value of after-tax cash inflow = $142,453

Year 3:

Cash inflow = $272,000

Depreciation = $54,000

Taxable income = $218,000

Tax expense = -$65,400

After-tax cash inflow = $206,600

Present value of after-tax cash inflow = $153,782

Year 4:

Cash inflow = $316,000

Depreciation = $54,000

Taxable income = $262,000

Tax expense = -$78,600

After-tax cash inflow = $237,400

Present value of after-tax cash inflow = $162,093

To calculate the net present value, we add up the present values of all cash inflows and outflows:

NPV = Present value of cash inflows - Initial investment

NPV = $132,143 + $142,453 + $153,782 + $162,093 - $480,000

NPV = $110,471

Since the NPV is positive, accepting the project would increase the value of the company. The closest answer is C) $180,471.

Learning Objectives

- Acquire and utilize knowledge of net present value for the analysis of investment projects.