Asked by Megan Shook on May 22, 2024

Verified

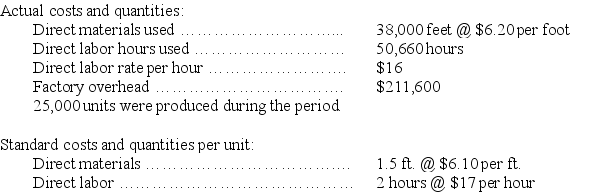

The following information comes from the records of Magno Co.for the current period.

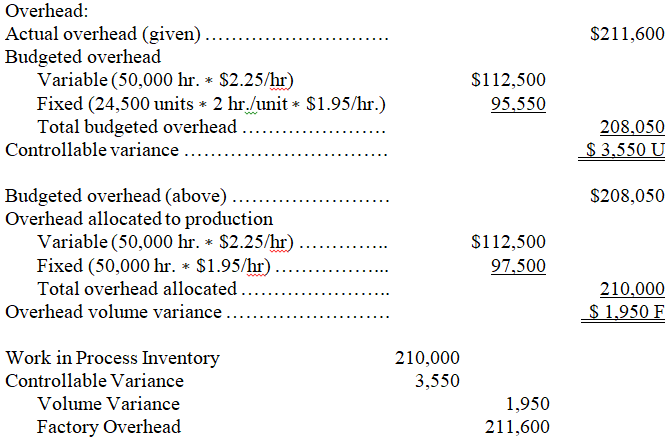

a.Compute the overhead controllable and volume variances.In each case,state whether the variance is favorable or unfavorable.

b.Prepare the journal entries to charge overhead costs to work in process and the overhead variances to their proper accounts.

Factory overhead (based on budgeted production of 24,500 units)

Factory overhead (based on budgeted production of 24,500 units)

Variable overhead $2.25/direct labor hour

Fixed overhead $1.95/direct labor hour

Overhead Controllable Variances

The portion of overhead costs that can be directly managed or influenced by decisions made by management.

Volume Variances

The difference between the planned or standard quantities expected and actual quantities, affecting inventory, sales, or production levels.

Work in Process

A term referring to items and materials that are being transformed into finished products but are not yet complete.

- Determine the differences in variable and fixed overhead costs and distinguish whether they are advantageous or disadvantageous.

- Draft journal entries to account for discrepancies and adjustments in standard costing.

Verified Answer

Learning Objectives

- Determine the differences in variable and fixed overhead costs and distinguish whether they are advantageous or disadvantageous.

- Draft journal entries to account for discrepancies and adjustments in standard costing.

Related questions

The Following Information Comes from the Records of Barney Co ...

Selected Information from Richards Company's Flexible Budget Is Presented Below ...

Rosser Company Produces a Container That Requires 4 Yards of ...

If a Company Records Inventory Purchases at Standard Cost and ...

The Variable Overhead Efficiency Variance for November Is ...