Asked by Michelle Warren on May 23, 2024

Verified

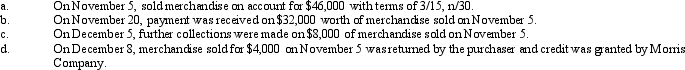

The following are transactions of the Morris Company:

Required:

Required:

Record the appropriate amounts under the gross price, net price, and allowance methods in the spaces below.For each method, write the amount to be debited or credited on the appropriate line for each account shown.Indicate that the amount is a debit or credit by placing a (d)or (c)after the amount.

a. To record sale on Nov. 5:

Gross Price Net Price Allowance Method Method Method Cash ____________ Accounts Receivable ____________ Sales ____________ Sales Discounts ____________ Allowance for Sales Discounts ____________ Sales Discounts Not Taken ____________ Sales Returns and.Allowances: ____________\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Accounts Receivable }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Allowance for Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts Not Taken }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Returns and.Allowances: }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method ____________________________ Net Price Method ____________________________ Allowance Method ____________________________ b. To record payment received on Nov. 20

Gross Price Net Price Allowance Method Method Method Cash ____________ Accounts Receivable ____________ Sales ____________ Sales Discounts ____________ Allowance for Sales Discounts ____________ Sales Discounts Not Taken ____________ Sales Returns and.Allowances: ____________\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Accounts Receivable }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Allowance for Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts Not Taken }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Returns and.Allowances: }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method ____________________________ Net Price Method ____________________________ Allowance Method ____________________________ c. To record payment recenved on Dec. 5:

Gross Price Net Price Allowance Method Method Method Cash ____________ Accounts Receivable ____________ Sales ____________ Sales Discounts ____________ Allowance for Sales Discounts ____________ Sales Discounts Not Taken ____________ Sales Returns and.Allowances: ____________\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Accounts Receivable }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Allowance for Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts Not Taken }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Returns and.Allowances: }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method ____________________________ Net Price Method ____________________________ Allowance Method ____________________________ d. To record sales returin on Dec.8:

Gross Price Net Price Allowance Method Method Method Cash ____________ Accounts Receivable ____________ Sales ____________ Sales Discounts ____________ Allowance for Sales Discounts ____________ Sales Discounts Not Taken ____________ Sales Returns and.Allowances: ____________\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Accounts Receivable }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Allowance for Sales Discounts }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Discounts Not Taken }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\text { Sales Returns and.Allowances: }&\_\_\_\_&\_\_\_\_&\_\_\_\_\\\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method ____________________________ Net Price Method ____________________________ Allowance Method ____________________________

Gross Price

The total cost of a good or service without deducting any discounts, taxes, or other expenses.

Net Price

The actual price paid for a product after deducting any discounts, rebates, or allowances from the list or gross price.

Allowance Method

An accounting technique that estimates and records bad debts expense from credit sales based on anticipated losses.

- Record transactions under various methods (gross price, net price, allowance).

Verified Answer

JH

Jennifer HaddockMay 23, 2024

Final Answer :

a. To record sale on Nov. 5:

\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\\\text { Accounts Receivable }&46,000(d) & 44,620(d) & 46,000(d) \\\text { Sales }&46,000(c) & 44,620(c) & 44,620(c)\\\text { Sales Discounts }&\\\text { Allowance for Sales Discounts }&&&1,380(c)\\\text { Sales Discounts Not Taken }&\\\text { Sales Returns and.Allowances: }&\\end{array} b. To record payment received on Nov. 20

Gross Price Net Price Allowance Method Method Method Cash 31,040(d)‾31,040(d)31,040(d) Accounts Receivable 32,000(c)31,040(c)32,000(c) Sales Sales Discounts 960(d) Allowance for Sales Discounts 960(d) Sales Discounts Not Taken Sales Returns and.Allowances: \begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash } & \overline{31,040(d)} & 31,040(d) & 31,040(d) \\\text { Accounts Receivable } & 32,000(c) & 31,040(c) & 32,000(c) \\\text { Sales } & & \\\text { Sales Discounts } & 960(d)\\\text { Allowance for Sales Discounts }& & & 960(d)\\\text { Sales Discounts Not Taken }&\\\text { Sales Returns and.Allowances: }&\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method 31,040(d)32,000(c)960(d) Net Price Method 31,040(d)31,040(c) Allowance Method 31,040(d)32,000(c)960(d) c. To record payment recenved on Dec. 5:

Gross Price Net Price Allowance Method Method Method Cash 8,000(d)8,000(d)8,000(d) AccountsReceivable 8,000(c)7,760(c)8,000(c) Sales Sales Discounts Allowance for Sales Discounts 240(d) Sales Discounts Not Taken 240(c)240(c) Sales Returns and.Allowances: \begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash } & 8,000(d) & 8,000(d) & 8,000(d) \\\text { AccountsReceivable } & 8,000(c) & 7,760(c) & 8,000(c)\\\text { Sales }&\\\text { Sales Discounts }&\\\text { Allowance for Sales Discounts }&&&240(d)\\\text { Sales Discounts Not Taken }&&240(c)&240(c)\\\text { Sales Returns and.Allowances: }&\end{array} Cash AccountsReceivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method 8,000(d)8,000(c) Net Price Method 8,000(d)7,760(c)240(c) Allowance Method 8,000(d)8,000(c)240(d)240(c) d. To record sales returin on Dec.8:

Gross Price Net Price Allowance Method Method Method Cash Accounts Receivable 4,000(c)3,880(c)4,000(c) Sales Sales Discounts Allowance for Sales Discounts 120(d) Sales Discounts Not Taken Sales Returns and.Allowances: 4,000(d)3,880(d)3,880(d)\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\\\text { Accounts Receivable }&4,000(c)&3,880(c)&4,000(c)\\\text { Sales }&\\\text { Sales Discounts }&\\\text { Allowance for Sales Discounts }&&&120(d)\\\text { Sales Discounts Not Taken }&\\\text { Sales Returns and.Allowances: }&4,000(d)&3,880(d)&3,880(d)\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method 4,000(c)4,000(d) Net Price Method 3,880(c)3,880(d) Allowance Method 4,000(c)120(d)3,880(d)

\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\\\text { Accounts Receivable }&46,000(d) & 44,620(d) & 46,000(d) \\\text { Sales }&46,000(c) & 44,620(c) & 44,620(c)\\\text { Sales Discounts }&\\\text { Allowance for Sales Discounts }&&&1,380(c)\\\text { Sales Discounts Not Taken }&\\\text { Sales Returns and.Allowances: }&\\end{array} b. To record payment received on Nov. 20

Gross Price Net Price Allowance Method Method Method Cash 31,040(d)‾31,040(d)31,040(d) Accounts Receivable 32,000(c)31,040(c)32,000(c) Sales Sales Discounts 960(d) Allowance for Sales Discounts 960(d) Sales Discounts Not Taken Sales Returns and.Allowances: \begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash } & \overline{31,040(d)} & 31,040(d) & 31,040(d) \\\text { Accounts Receivable } & 32,000(c) & 31,040(c) & 32,000(c) \\\text { Sales } & & \\\text { Sales Discounts } & 960(d)\\\text { Allowance for Sales Discounts }& & & 960(d)\\\text { Sales Discounts Not Taken }&\\\text { Sales Returns and.Allowances: }&\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method 31,040(d)32,000(c)960(d) Net Price Method 31,040(d)31,040(c) Allowance Method 31,040(d)32,000(c)960(d) c. To record payment recenved on Dec. 5:

Gross Price Net Price Allowance Method Method Method Cash 8,000(d)8,000(d)8,000(d) AccountsReceivable 8,000(c)7,760(c)8,000(c) Sales Sales Discounts Allowance for Sales Discounts 240(d) Sales Discounts Not Taken 240(c)240(c) Sales Returns and.Allowances: \begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash } & 8,000(d) & 8,000(d) & 8,000(d) \\\text { AccountsReceivable } & 8,000(c) & 7,760(c) & 8,000(c)\\\text { Sales }&\\\text { Sales Discounts }&\\\text { Allowance for Sales Discounts }&&&240(d)\\\text { Sales Discounts Not Taken }&&240(c)&240(c)\\\text { Sales Returns and.Allowances: }&\end{array} Cash AccountsReceivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method 8,000(d)8,000(c) Net Price Method 8,000(d)7,760(c)240(c) Allowance Method 8,000(d)8,000(c)240(d)240(c) d. To record sales returin on Dec.8:

Gross Price Net Price Allowance Method Method Method Cash Accounts Receivable 4,000(c)3,880(c)4,000(c) Sales Sales Discounts Allowance for Sales Discounts 120(d) Sales Discounts Not Taken Sales Returns and.Allowances: 4,000(d)3,880(d)3,880(d)\begin{array}{lll}&\text { Gross Price } & \text { Net Price } & \text { Allowance } \\&\text { Method } & \text { Method } & \text { Method }\\\text { Cash }&\\\text { Accounts Receivable }&4,000(c)&3,880(c)&4,000(c)\\\text { Sales }&\\\text { Sales Discounts }&\\\text { Allowance for Sales Discounts }&&&120(d)\\\text { Sales Discounts Not Taken }&\\\text { Sales Returns and.Allowances: }&4,000(d)&3,880(d)&3,880(d)\end{array} Cash Accounts Receivable Sales Sales Discounts Allowance for Sales Discounts Sales Discounts Not Taken Sales Returns and.Allowances: Gross Price Method 4,000(c)4,000(d) Net Price Method 3,880(c)3,880(d) Allowance Method 4,000(c)120(d)3,880(d)

Learning Objectives

- Record transactions under various methods (gross price, net price, allowance).