Asked by mahesh likhe on Jun 18, 2024

Verified

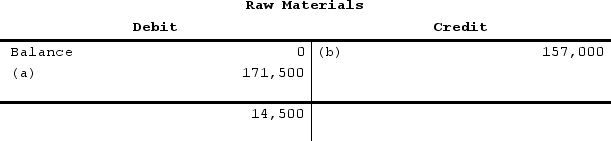

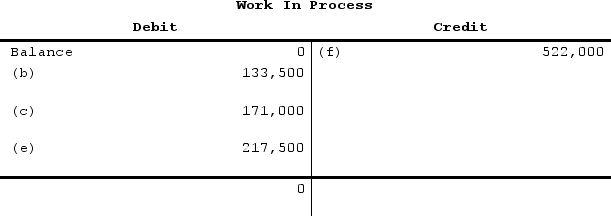

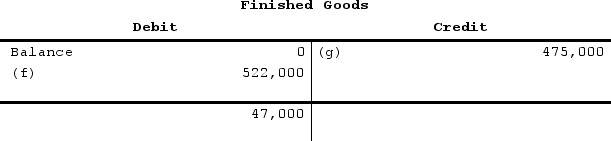

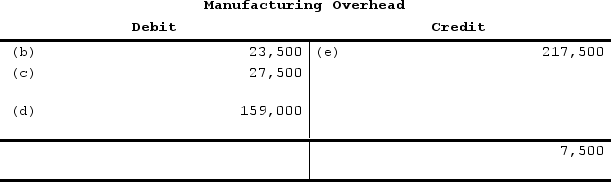

The following accounts are from last year's books at Sharp Manufacturing:

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the amount of cost of goods manufactured for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the amount of cost of goods manufactured for the year?

A) $257,250

B) $467,500

C) $522,000

D) $475,000

Job-Order Costing

An accounting method used to track costs and revenues by specific jobs or orders, commonly used in industries with customized products.

Direct Labor Costs

The wages and benefits paid to workers who are directly involved in the manufacturing of products.

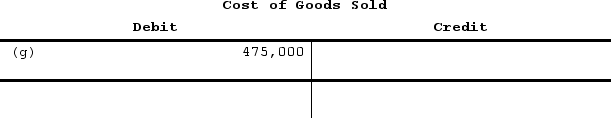

Cost Of Goods Manufactured

The total production cost of the goods completed and transferred out of the work-in-process inventory during a specific period.

- Uncover and quantify the cost associated with goods creation from specified data.

Verified Answer

Job 1: Direct materials = $40,000, Direct labor = $25,000, Manufacturing overhead applied = $30,000

Total cost = $95,000

Job 2: Direct materials = $53,500, Direct labor = $47,500, Manufacturing overhead applied = $57,000

Total cost = $158,000

Job 3: Direct materials = $65,000, Direct labor = $55,000, Manufacturing overhead applied = $66,000

Total cost = $186,000

Job 4: Direct materials = $28,500, Direct labor = $22,500, Manufacturing overhead applied = $27,000

Total cost = $78,000

Job 5: Direct materials = $38,000, Direct labor = $32,000, Manufacturing overhead applied = $38,000

Total cost = $108,000

Total cost of goods manufactured = $95,000 + $158,000 + $186,000 + $78,000 + $108,000 = $625,000.

Therefore, the correct answer is C) $522,000.

Learning Objectives

- Uncover and quantify the cost associated with goods creation from specified data.

Related questions

Rediger Incorporated a Manufacturing Corporation, Has Provided the Following Data ...

Durphey Corporation Has Provided the Following Data Concerning Last Month's ...

The Cost of Goods Sold for Michaels Manufacturing in the ...

Laramie Technologies Had the Following Data: Determine the Cost ...

Gurtner Corporation Has Provided the Following Data Concerning Last Month's ...