Asked by ethan battista on May 14, 2024

Verified

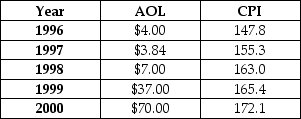

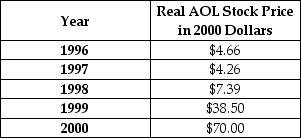

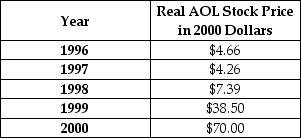

The first column of the following table describes the price movement of AOL Corporation stock over a five-year period. The second column gives the period's consumer price index. Calculate the real value of the stock for each time period using year 5 as the base year. If you purchased $1,000 worth of AOL Corporation in year 1, what has happened to the purchasing power of your original $1,000 investment when you sell the stock in year 5?

AOL Corporation

An American web portal and online service provider, which historically offered a branded internet service that allowed users to connect to the internet and access its own network of content.

Consumer Price Index

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, used to estimate inflation.

Purchasing Power

The value of a currency expressed in terms of the amount of goods or services that one unit of money can buy.

- Determine and explain the true value of goods and investments across different periods, taking inflation into account.

- Use consumer price index (CPI) data to compare costs and purchasing power across different times and locations.

Verified Answer

MC

Meesha ChaudhariMay 18, 2024

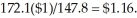

Final Answer :  The real value of a year 1996 dollar in 2000 is

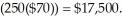

The real value of a year 1996 dollar in 2000 is  I would have bought 250 shares of AOL at 1996 prices (ignoring transaction costs) with the $1,000. The value of the stock in the year 2000 is

I would have bought 250 shares of AOL at 1996 prices (ignoring transaction costs) with the $1,000. The value of the stock in the year 2000 is  The change in my purchasing power is

The change in my purchasing power is  That is, my purchasing power from investing in the stock rises by 1,409%.

That is, my purchasing power from investing in the stock rises by 1,409%.

The real value of a year 1996 dollar in 2000 is

The real value of a year 1996 dollar in 2000 is  I would have bought 250 shares of AOL at 1996 prices (ignoring transaction costs) with the $1,000. The value of the stock in the year 2000 is

I would have bought 250 shares of AOL at 1996 prices (ignoring transaction costs) with the $1,000. The value of the stock in the year 2000 is  The change in my purchasing power is

The change in my purchasing power is  That is, my purchasing power from investing in the stock rises by 1,409%.

That is, my purchasing power from investing in the stock rises by 1,409%.

Learning Objectives

- Determine and explain the true value of goods and investments across different periods, taking inflation into account.

- Use consumer price index (CPI) data to compare costs and purchasing power across different times and locations.