Asked by Louella Jackson on May 18, 2024

Verified

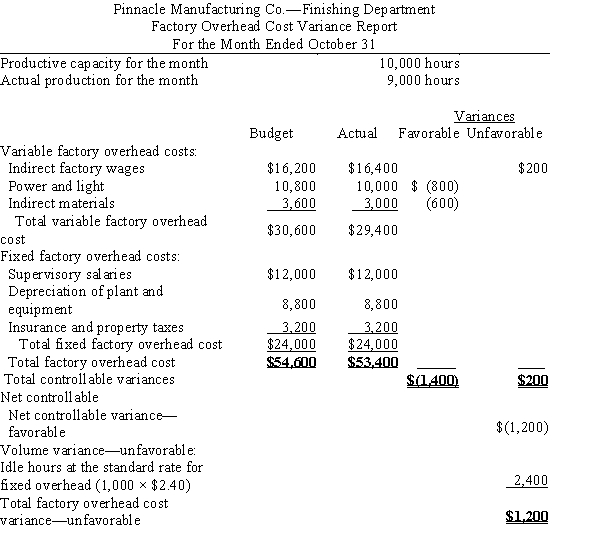

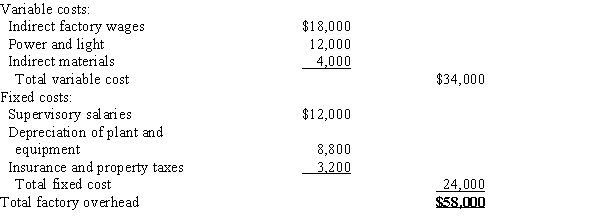

The Finishing Department of Pinnacle Manufacturing Co. prepared the following factory overhead cost budget for October of the current year, during which it expected to operate at a 100% capacity of 10,000 machine hours.  During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.Prepare a factory overhead cost variance report for October.

During October, the plant was operated for 9,000 machine hours and the factory overhead costs incurred were as follows: indirect factory wages, $16,400; power and light, $10,000; indirect materials, $3,000; supervisory salaries, $12,000; depreciation of plant and equipment, $8,800; insurance and property taxes, $3,200.Prepare a factory overhead cost variance report for October.

(The budgeted amounts for actual amount produced should be based on 9,000 machine hours.)

Factory Overhead Cost

All of the costs of producing a product except for direct materials and direct labor.

Depreciation

The process of allocating the cost of a tangible or physical asset over its useful life, reflecting the asset's consumption or wear and tear.

Indirect Factory Wages

Wages paid to workers who are not directly involved in production, such as supervisors and maintenance staff, considered part of manufacturing overhead.

- Attain proficiency in computing variances in variable and fixed factory overhead, including aspects of controllable, volume, and aggregate cost deviations.

Verified Answer

Learning Objectives

- Attain proficiency in computing variances in variable and fixed factory overhead, including aspects of controllable, volume, and aggregate cost deviations.

Related questions

Greyson Company Produced 8,300 Units of Product That Required 4 ...

The Following Information Relates to Manufacturing Overhead for Chapman Company ...

Tucker Company Produced 8,900 Units of Product That Required 3 ...

Incurring Actual Indirect Factory Wages in Excess of Budgeted Amounts ...

The Variable Factory Overhead Controllable Variance Is