Asked by Gilberto Camacho on Jun 08, 2024

Verified

The estimated direct labor cost for November is closest to:

A) $320,000

B) $182,620

C) $456,550

D) $19,850

Estimated Direct Labor Cost

The anticipated cost of labor directly associated with the production of goods or services, typically estimated before production begins.

- Comprehend the influence of direct labor expenses on the manufacturing budget.

Verified Answer

MM

Mohammad Mahdi MalekiJun 08, 2024

Final Answer :

C

Explanation :

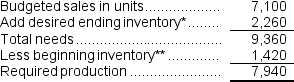

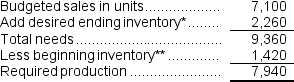

The budgeted required production for November is computed as follows:  *December sales of 11,300 units × 20% = 2,260 units

*December sales of 11,300 units × 20% = 2,260 units

** November sales of 7,100 units × 20%= 1,420 units

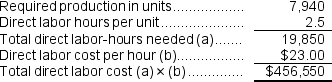

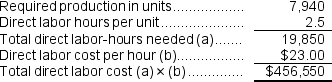

The estimated direct labor cost for November is computed as follows: Reference: CH08-Ref5

Reference: CH08-Ref5

Michard Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:

a.The budgeted selling price per unit is $125.Budgeted unit sales for April, May, June, and July are 7,600, 10,500, 13,800, and 12,900 units, respectively.All sales are on credit.

b.Regarding credit sales, 20% are collected in the month of the sale and 80% in the following month.

c.The ending finished goods inventory equals 20% of the following month's sales.

d.The ending raw materials inventory equals 30% of the following month's raw materials production needs.Each unit of finished goods requires 4 pounds of raw materials.The raw materials cost $2.00 per pound.

e.Regarding raw materials purchases, 30% are paid for in the month of purchase and 70% in the following month.

f.The direct labor wage rate is $25.00 per hour.Each unit of finished goods requires 3.0 direct labor-hours.

g.The variable selling and administrative expense per unit sold is $3.40.The fixed selling and administrative expense per month is $80,000.

*December sales of 11,300 units × 20% = 2,260 units

*December sales of 11,300 units × 20% = 2,260 units** November sales of 7,100 units × 20%= 1,420 units

The estimated direct labor cost for November is computed as follows:

Reference: CH08-Ref5

Reference: CH08-Ref5Michard Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:

a.The budgeted selling price per unit is $125.Budgeted unit sales for April, May, June, and July are 7,600, 10,500, 13,800, and 12,900 units, respectively.All sales are on credit.

b.Regarding credit sales, 20% are collected in the month of the sale and 80% in the following month.

c.The ending finished goods inventory equals 20% of the following month's sales.

d.The ending raw materials inventory equals 30% of the following month's raw materials production needs.Each unit of finished goods requires 4 pounds of raw materials.The raw materials cost $2.00 per pound.

e.Regarding raw materials purchases, 30% are paid for in the month of purchase and 70% in the following month.

f.The direct labor wage rate is $25.00 per hour.Each unit of finished goods requires 3.0 direct labor-hours.

g.The variable selling and administrative expense per unit sold is $3.40.The fixed selling and administrative expense per month is $80,000.

Learning Objectives

- Comprehend the influence of direct labor expenses on the manufacturing budget.