Asked by Aliyana Shivji on Jun 07, 2024

Verified

The estimated direct labor cost for May is closest to:

A) $786,800

B) $31,472

C) $534,000

D) $281,000

Direct Labor Cost

The compensation given to workers who are directly engaged in manufacturing products or providing services.

- Comprehend the principles and numerical methods utilized in the formulation of a direct labor budget.

Verified Answer

JV

jolly varkeyJun 14, 2024

Final Answer :

A

Explanation :

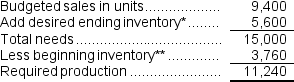

The budgeted required production for May is computed as follows:  *June sales of 14,000 units × 40% = 5,600 units

*June sales of 14,000 units × 40% = 5,600 units

** May sales of 9,400 units × 40%= 3,760 units

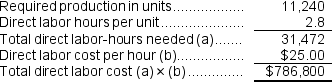

The estimated direct labor cost for May is computed as follows: Reference: CH08-Ref4

Reference: CH08-Ref4

Rokosz Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:

a.The budgeted selling price per unit is $104.Budgeted unit sales for October, November, December, and January are 6,900, 7,100, 11,300, and 15,300 units, respectively.All sales are on credit.

b.Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month.

c.The ending finished goods inventory equals 20% of the following month's sales.

d.The ending raw materials inventory equals 30% of the following month's raw materials production needs.Each unit of finished goods requires 5 pounds of raw materials.The raw materials cost $2.00 per pound.

e.The direct labor wage rate is $23.00 per hour.Each unit of finished goods requires 2.5 direct labor-hours.

*June sales of 14,000 units × 40% = 5,600 units

*June sales of 14,000 units × 40% = 5,600 units** May sales of 9,400 units × 40%= 3,760 units

The estimated direct labor cost for May is computed as follows:

Reference: CH08-Ref4

Reference: CH08-Ref4Rokosz Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:

a.The budgeted selling price per unit is $104.Budgeted unit sales for October, November, December, and January are 6,900, 7,100, 11,300, and 15,300 units, respectively.All sales are on credit.

b.Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month.

c.The ending finished goods inventory equals 20% of the following month's sales.

d.The ending raw materials inventory equals 30% of the following month's raw materials production needs.Each unit of finished goods requires 5 pounds of raw materials.The raw materials cost $2.00 per pound.

e.The direct labor wage rate is $23.00 per hour.Each unit of finished goods requires 2.5 direct labor-hours.

Learning Objectives

- Comprehend the principles and numerical methods utilized in the formulation of a direct labor budget.

Related questions

Depasquale Corporation Is Working on Its Direct Labor Budget for ...

Tracie Corporation Manufactures and Sells Women's Skirts ...

LBC Corporation Makes and Sells a Product Called Product WZ ...

Romeiro Corporation Is Preparing Its Cash Budget for September ...

Weller Industrial Gas Corporation Supplies Acetylene and Other Compressed Gases ...