Asked by Osano Enoch on Jul 08, 2024

Verified

The current stock price of Alcoco is $70, and the stock does not pay dividends. The instantaneous risk-free rate of return is 6%. The instantaneous standard deviation of Alcoco's stock is 40%. You want to purchase a call option on this stock with an exercise price of $75 and an expiration date 30 days from now. Based on the Black-Scholes OPM, the call option's delta will be ________.

A) 0.28

B) 0.31

C) 0.62

D) 0.70

Call Option's Delta

A measure of how much the price of a call option is expected to change based on a one unit change in the price of the underlying asset.

Black-Scholes OPM

A model used to estimate the price of European-style options, leveraging factors such as underlying asset price, strike price, volatility, and time to expiration.

Instantaneous Risk-free Rate

The theoretical rate of return of an investment with zero risk at any given moment, used in certain financial models.

- Understand the principles of hedge ratios and deltas within options trading.

Verified Answer

DM

Desiree' MonroeJul 15, 2024

Final Answer :

B

Explanation :

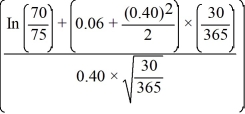

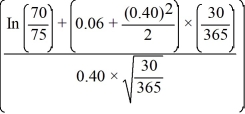

△ = N = N (− 0.50129) = 0.308084

= N (− 0.50129) = 0.308084

△ = N (d1) = 0.308084

△ = N

= N (− 0.50129) = 0.308084

= N (− 0.50129) = 0.308084△ = N (d1) = 0.308084

Learning Objectives

- Understand the principles of hedge ratios and deltas within options trading.