Asked by Annette Herrera on Jun 23, 2024

Verified

The company's acid-test (quick) ratio is closest to:

A) 2.47

B) 2.83

C) 3.10

D) 4.25

Acid-Test Ratio

A liquidity ratio that measures a company's ability to pay off its current liabilities with quick assets (cash, marketable securities, and accounts receivable).

Company

A business entity established by a collection of people to conduct and manage a commercial venture.

- Ascertain and interpret the acid-test (quick) ratio to gauge a company's immediate financial fluidity, not including inventory in the assessment.

Verified Answer

BS

Baila SkendzielJun 28, 2024

Final Answer :

B

Explanation :

Acid-test (quick)ratio = Quick assets* ÷ Current liabilities

= $473,000 ÷ $167,000 = 2.83 (rounded)

*Quick assets = Cash + Marketable securities + Current receivables

= $188,000 + $0 + $285,000 = $473,000

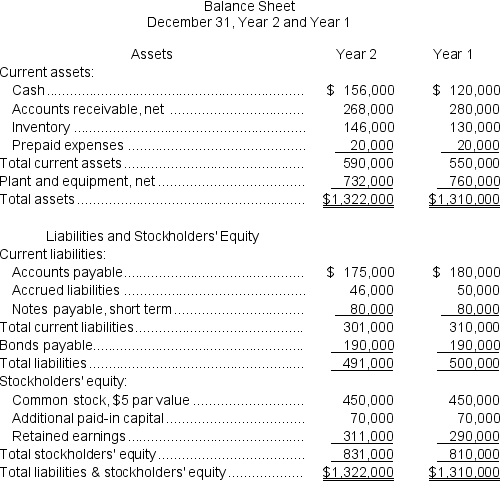

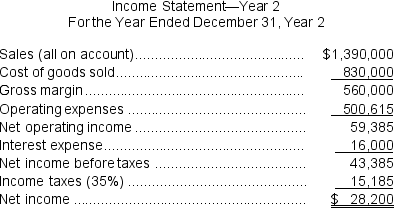

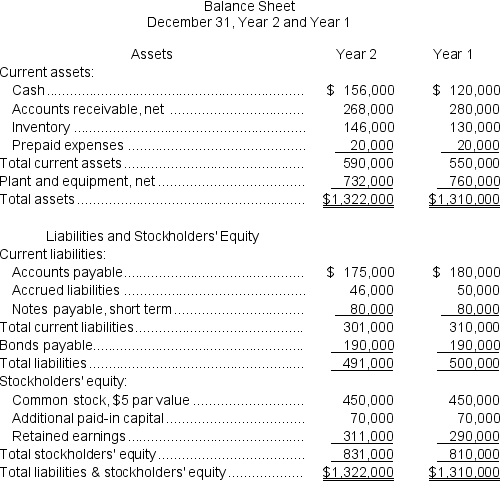

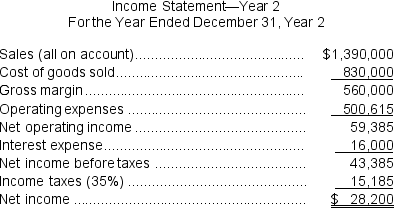

Reference: CH14-Ref2

Macmillan Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $7,200.The market price of common stock at the end of Year 2 was $3.69 per share.

Dividends on common stock during Year 2 totaled $7,200.The market price of common stock at the end of Year 2 was $3.69 per share.

= $473,000 ÷ $167,000 = 2.83 (rounded)

*Quick assets = Cash + Marketable securities + Current receivables

= $188,000 + $0 + $285,000 = $473,000

Reference: CH14-Ref2

Macmillan Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $7,200.The market price of common stock at the end of Year 2 was $3.69 per share.

Dividends on common stock during Year 2 totaled $7,200.The market price of common stock at the end of Year 2 was $3.69 per share.

Learning Objectives

- Ascertain and interpret the acid-test (quick) ratio to gauge a company's immediate financial fluidity, not including inventory in the assessment.