Asked by Jalen Taper on May 31, 2024

Verified

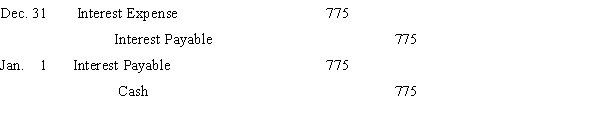

The company determines that the interest expense on a note payable for the period ending December 31 is $775. This amount is payable on January 1. Prepare the journal entries required on December 31 and January 1.

Interest Expense

The cost incurred by an entity for borrowed funds, denoted as an expense within the income statement.

Note Payable

A written agreement that represents a promise to pay a specified amount of money on demand or at a designated future date.

Journal Entries

The recording of financial transactions in a company's accounting system.

- Exhibit the proficiency in developing journal entries for standard adjusting entries, such as prepayments, accruals, and depreciation.

- Apply calculations and chronicle changes for pre-disbursed and accrued monetary obligations.

Verified Answer

ZK

Learning Objectives

- Exhibit the proficiency in developing journal entries for standard adjusting entries, such as prepayments, accruals, and depreciation.

- Apply calculations and chronicle changes for pre-disbursed and accrued monetary obligations.

Related questions

The Prepaid Insurance Account Had a Beginning Balance of $6,600 ...

On December 31, the Balance in the Office Supplies Account ...

Gizmo Company Purchased a One-Year Insurance Policy on October 1 ...

DogMart Company Records Depreciation for Equipment ...

The Balance in the Unearned Fees Account, Before Adjustment at ...