Asked by Hailey Bojack on May 26, 2024

Verified

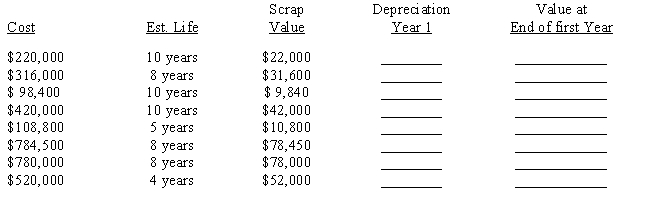

The California Crane Company purchased eight new cranes of different sizes and qualities. CCC uses the double-declining balance method of calculating depreciation. The data for each crane is given below. From this data, compute the first year depreciation for each crane and the value of each crane at the end of its first year of use.

Double-Declining-Balance

A method of accelerated depreciation in which an asset's book value is reduced by double the rate of its straight-line depreciation.

Crane

A tall machine used for moving heavy objects by suspending them from a projecting arm or beam.

- Derive the book value of assets by leveraging different depreciation methods.

- Compute the depreciation charges for fixed periods via the double-declining-balance technique.

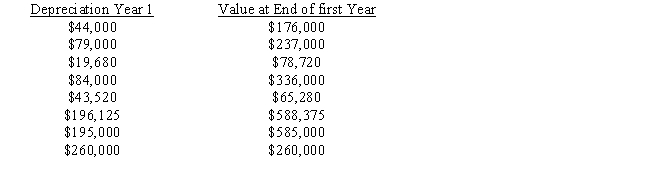

Verified Answer

KM

Learning Objectives

- Derive the book value of assets by leveraging different depreciation methods.

- Compute the depreciation charges for fixed periods via the double-declining-balance technique.