Asked by ashanti morris on Jun 09, 2024

Verified

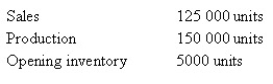

The Browning Company manufactures a single product; the standard costs per unit being variable manufacturing $8, fixed manufacturing $6. Selling and administrative costs are $2 per unit sold. The selling price is $20 per unit. Actual and budgeted fixed overhead is $900,000 for the year. Information about Browning's production activity for the year is:

What is the profit under variable costing?

A) $1 250 000

B) $350 000

C) $500 000

D) Insufficient information to determine

Variable Costing

An accounting method that only includes variable manufacturing costs (direct materials, direct labor, and variable manufacturing overhead) in product costs.

Fixed Overhead

Costs that do not vary with the level of production or sales, such as rent, salaries, and insurance.

Selling Price

The amount of money charged for a product or service, or the sum of the value that customers exchange for the benefits of having or using the product or service.

- Assess the impact of different costing methods (variable costing and absorption costing) on financial performance.

Verified Answer

Using the information provided in the chart, total units produced and sold for the year is 500,000.

Total variable cost = $8 x 500,000 = $4,000,000

Total fixed manufacturing overhead = $900,000

Total fixed cost per unit = ($6 / 20) x 500,000 = $150,000

Total cost of goods sold = $4,000,000 + $150,000 = $4,150,000

Total contribution margin = $10 x 500,000 = $5,000,000

Total net income under variable costing = Total contribution margin - Total fixed cost = $5,000,000 - $900,000 = $4,100,000

Profit = Sales - Total variable cost - Total fixed cost = $20 x 500,000 - $4,000,000 - $900,000 = $350,000.

Learning Objectives

- Assess the impact of different costing methods (variable costing and absorption costing) on financial performance.

Related questions

Absorption Costing Makes It Difficult for Financial Statement Users to ...

Variable Costing Is an Acceptable Costing Method for GAAP

In an Absorption Costing Income Statement, the Manufacturing Margin Is ...

Absorption Costing Is Required for Financial Reporting Under Generally Accepted ...

Under Variable Costing, What Is McCoy's Net Operating Income for ...