Asked by Nikki Tajdar on Jun 21, 2024

Verified

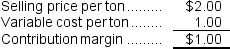

The Anaconda Mining Company currently is operating at less than 50 percent of practical capacity.The management of the company expects sales to drop below the present level of 15,000 tons of ore per month very soon.The selling price per ton of ore is $2 and the variable cost per ton is $1.Fixed costs per month total $15,000.

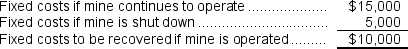

Management is concerned that a further drop in sales volume will generate a loss and, accordingly, is considering the temporary suspension of operations until demand in the metals markets returns to normal levels and prices rebound.Management has implemented a cost reduction program over the past year that has been successful in reducing costs.Nevertheless, suspension of operations appears to be the only viable alternative.Management estimates that suspension of operations would reduce fixed costs from $15,000 to $5,000 per month.

Required:

a.Why does management estimate that fixed costs will persist at $5,000 per month even though the mine is temporarily closed?

b.At what sales volume should management suspend operations at the mine?

Practical Capacity

The maximum output that a company can produce in a real-life scenario, taking into account planned maintenance, breaks, and other non-operational activities.

Variable Cost

A cost that varies, in total, in direct proportion to changes in the level of activity. A variable cost is constant per unit.

Fixed Costs

Expenses that do not change with the level of production or sales, such as rent, salaries, and insurance.

- Review the fiscal effects of starting or discontinuing a product line, bearing in mind appropriate and inappropriate costs.

- Attain insight into the idea of differential cost and its relevance to decisions in business contexts.

Verified Answer

b.Suspension of operations would be desirable when sales volume drops below 10,000 tons as shown below:

Each ton extracted contributes $1.00 per ton towards fixed costs:

Each ton extracted contributes $1.00 per ton towards fixed costs:  Sales volume necessary to recover $10,000 of fixed costs:

Sales volume necessary to recover $10,000 of fixed costs:$10,000 ÷ $1.00 = 10,000 tons

Learning Objectives

- Review the fiscal effects of starting or discontinuing a product line, bearing in mind appropriate and inappropriate costs.

- Attain insight into the idea of differential cost and its relevance to decisions in business contexts.

Related questions

Recher Corporation Uses Part Q89 in One of Its Products ...

The Management of Schmader Corporation Is Considering Dropping Product M12C ...

Saalfrank Corporation Is Considering Two Alternatives That Are Code-Named M ...

Costs Associated with Two Alternatives, Code-Named Q and R, Being ...

Lakeshore Tours Inc ...