Asked by Andrew Elmowitz on May 19, 2024

Verified

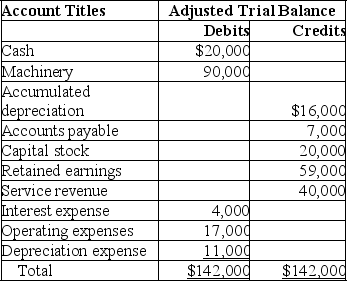

The adjusted trial balance of Tahoe Company at the end of the accounting year,December 31,2019,showed the following:

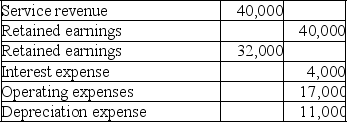

A.Prepare all the required closing entries for Tahoe Company at December 31,2019.

A.Prepare all the required closing entries for Tahoe Company at December 31,2019.

B.Calculate the 2019 ending balance in retained earnings.

Adjusted Trial Balance

An adjusted trial balance is a list of all the accounts of a company, showing the balances after adjusting entries have been made for accruals, deferrals, and other adjustments.

Closing Entries

Journal entries made at the end of an accounting period to transfer the balances in temporary accounts to permanent accounts and to prepare the company's books for the next period.

Retained Earnings

The portion of net earnings not paid out as dividends but retained by the company to be reinvested in its core business or to pay debt.

- Understand the process for preparing closing entries in accounting.

- Ascertain net income, accumulated earnings, and per-share income.

Verified Answer

B.$59,000 + $8,000* = $67,000 (balance of retained earnings at the end of 2019).

B.$59,000 + $8,000* = $67,000 (balance of retained earnings at the end of 2019).* ($40,000 - $32,000)

Learning Objectives

- Understand the process for preparing closing entries in accounting.

- Ascertain net income, accumulated earnings, and per-share income.

Related questions

Johnson Corporation Is Completing the Accounting Information Processing Cycle at ...

Use the End-Of-Period Spreadsheet for Finley Company ...

The Special Account Used Only in the Closing Process to ...

All Income Statement Accounts Will Be Closed at the End ...

Closing Entries Are Entered Directly on to the Work Sheet