Asked by Natalia Portugal on May 25, 2024

Verified

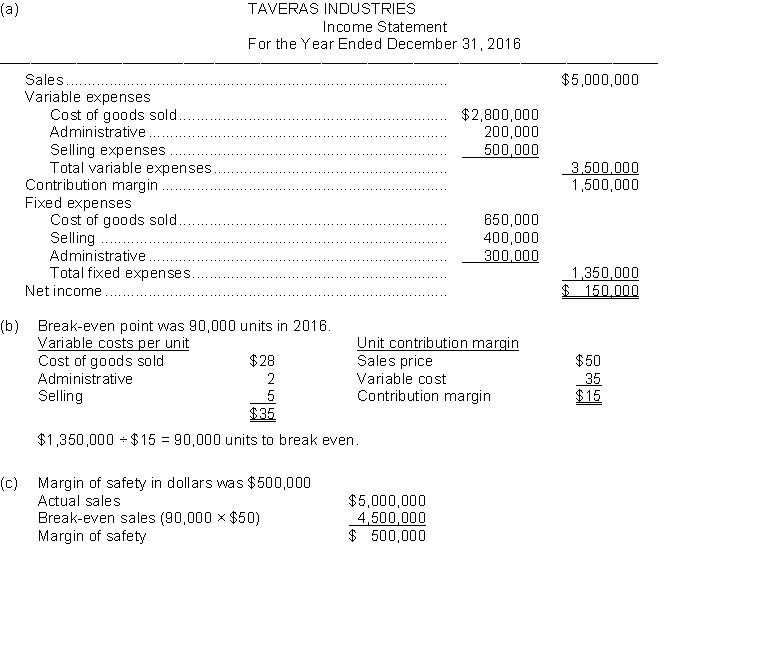

Taveras Industries developed the following information for the product it sells: Sales price $50 per unit Variable cost of goods sold $28 per unit Fixed cost of goods sold $650,000 Variable selling expense 10% of sales price Variable administrative expense $2.00 per unit Fixed selling expense $400,000 Fixed administrative expense $300,000\begin{array}{ll}\text { Sales price } & \$ 50 \text { per unit } \\\text { Variable cost of goods sold } & \$ 28 \text { per unit } \\\text { Fixed cost of goods sold } & \$ 650,000 \\\text { Variable selling expense } & 10 \% \text { of sales price } \\\text { Variable administrative expense } & \$ 2.00 \text { per unit } \\\text { Fixed selling expense } & \$ 400,000 \\\text { Fixed administrative expense } & \$ 300,000\end{array} Sales price Variable cost of goods sold Fixed cost of goods sold Variable selling expense Variable administrative expense Fixed selling expense Fixed administrative expense $50 per unit $28 per unit $650,00010% of sales price $2.00 per unit $400,000$300,000 For the year ended December 31 2016 Taveras produced and sold 100000 units of product.

Instructions

(a) Prepare a CVP income statement using the contribution margin format for Taveras Industries for 2016.

(b) What was the company's break-even point in units in 2016? Use the contribution margin technique.

(c) What was the company's margin of safety in dollars in 2016?

Variable Cost of Goods Sold

These are costs that fluctuate in direct proportion to changes in the level of production or sales volume, such as raw materials and direct labor.

Fixed Cost of Goods Sold

A portion of the cost of goods sold that remains constant, regardless of the level of production or sales.

Contribution Margin Format

A costing format that highlights the contribution margin, which is sales revenue minus variable costs, used in management accounting.

- Acquire foundational knowledge in executing a Cost-Volume-Profit (CVP) analysis.

- Evaluate the break-even points, quantitatively and financially, through the alteration of input variables.

- Generate and decode a CVP income statement, acknowledging its value in management's strategic decision processes.

Verified Answer

AI

Learning Objectives

- Acquire foundational knowledge in executing a Cost-Volume-Profit (CVP) analysis.

- Evaluate the break-even points, quantitatively and financially, through the alteration of input variables.

- Generate and decode a CVP income statement, acknowledging its value in management's strategic decision processes.