Asked by Yocabed Efrem on May 21, 2024

Verified

Stewart Corporation's balance sheet at December 31 2016 showed the following:

Short-term investments at fair value $46500

Stewart Corporation's trading portfolio of stock investments consisted of the following at December 31 2016: Stock ‾ Number of Shares ‾ Cost ‾ Conn Common Stock 200$28,000 Ares Preferred Stock 4006,000 Hall Common Stock 300$9,000‾$43,000‾\begin{array}{ccc} \underline{\text { Stock }}& \underline{\text { Number of Shares }}& \underline{\text { Cost }}\\\text { Conn Common Stock } & 200 & \$ 28,000 \\\text { Ares Preferred Stock } & 400 & 6,000 \\\text { Hall Common Stock } & 300 & \underline{\$9, 000} \\& & \underline{\$ 43,000}\end{array} Stock Conn Common Stock Ares Preferred Stock Hall Common Stock Number of Shares 200400300 Cost $28,0006,000$9,000$43,000 During 2017 the following transactions took place:

Feb. 5 Sold 100 shares of Conn common stock for $18000.

Mar. 30 Purchased 25 shares of Hall common stock for $1000.

Sept. 9 Purchased 50 shares of Hall common stock for $3000.

At year end on December 31 2017 the fair values per share were: Fair Value Per Share ‾ Conn Common Stock $158,00 Ares Preferred Stock $14.00 Hall Common Stock $24.00\begin{array} { l c } & \underline{\text { Fair Value Per Share }} \\\text { Conn Common Stock }&\$158,00\\\text { Ares Preferred Stock } & \$ 14.00 \\\text { Hall Common Stock } & \$ 24.00\end{array} Conn Common Stock Ares Preferred Stock Hall Common Stock Fair Value Per Share $158,00$14.00$24.00 Instructions

(a) Prepare the journal entries to record the 2017 stock transactions.

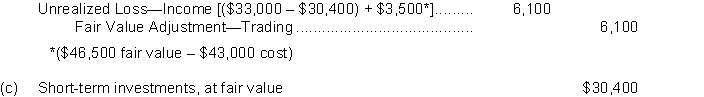

(b) On December 31 2017 prepare any adjusting entry that might be necessary relative to the trading portfolio.

(c) Show how the stock investments will appear on Stewart Corporation's balance sheet at December 31 2017.

Trading Portfolio

A collection of financial assets such as stocks, bonds, commodities, currencies, and derivatives held by an investor, primarily for the purpose of short-term speculation.

Stock Transactions

Activities involving the buying, selling, or issuing of shares of stocks in a company, either through exchanges or over-the-counter markets.

Stock Investments

A financial asset purchased in a corporation with the expectation of earning a return through dividends, stock price appreciation, or both.

- Quantify and make entries in account books the increments, decrements, dividends procured, and interest-related income from investments.

- Differentiate between recognized and unrecognized gains and losses, along with their accounting treatments for various investment categories.

- Keep records of transactions concerning the acquisition, sale, and retention of investment securities, including recalibrations for fair value.

Verified Answer

Feb. 5Cash 19,000 Stock Investments (100÷200×$28,000)14,000 Gain on Sale of Stock Investments 4,000 (To record sale of 100 shares of Conn common stock) Mar. 30Stock Investments.1,000 Cash1,000 (To record purchase of 25 shares of Hall common stock) Sept. 9Stock Investments.3,000 Cash3,000 (To record purchase of 50 shares of Hall common stack \begin{array}{llr} \text {Feb. 5\quad Cash } &19,000\\ \quad\quad\quad\text { Stock Investments \( (100 \div 200 \times \$ 28,000) \)} &&14,000\\\quad\quad\quad \text { Gain on Sale of Stock Investments } &&4,000\\\quad\quad\quad \text { (To record sale of 100 shares of Conn } &\\ \quad\quad\quad\text {common stock) } &\\\\ \text { Mar. 30\quad Stock Investments.} &1,000\\ \quad\quad\quad\quad\text { Cash} &&1,000\\ \quad\quad\quad\quad\text { (To record purchase of 25 shares of Hall } &\\\quad\quad\quad\quad \text {common stock) } &\\\\ \text { Sept. 9\quad Stock Investments.} &3,000\\ \quad\quad\quad\quad\text { Cash} &&3,000\\\quad\quad\quad\quad \text { (To record purchase of 50 shares of Hall } &\\\quad\quad\quad\quad \text { common stack } &\\\end{array}Feb. 5Cash Stock Investments (100÷200×$28,000) Gain on Sale of Stock Investments (To record sale of 100 shares of Conn common stock) Mar. 30Stock Investments. Cash (To record purchase of 25 shares of Hall common stock) Sept. 9Stock Investments. Cash (To record purchase of 50 shares of Hall common stack 19,0001,0003,00014,0004,0001,0003,000

(b)

Stack ‾ Number of Shares ‾ Cost ‾ Fair Value ‾Conn Common Stock100$14,000$15,800Ares Preferred Stock4006,0005,600 Hall Common Stock37513,0009,000$33,000$30,400\begin{array}{cccc} \underline{\text { Stack }}& \underline{\text { Number of Shares } }& \underline{\text { Cost }} & \underline{\text { Fair Value }}\\\text {Conn Common Stock}&100 & \$ 14,000 & \$ 15,800 \\ \text {Ares Preferred Stock}&400 & 6,000 & 5,600 \\\text { Hall Common Stock}&375 & 13,000 & 9,000 \\&& \$ 33,000 & \$ 30,400\end{array} Stack Conn Common StockAres Preferred Stock Hall Common Stock Number of Shares 100400375 Cost $14,0006,00013,000$33,000 Fair Value $15,8005,6009,000$30,400

Learning Objectives

- Quantify and make entries in account books the increments, decrements, dividends procured, and interest-related income from investments.

- Differentiate between recognized and unrecognized gains and losses, along with their accounting treatments for various investment categories.

- Keep records of transactions concerning the acquisition, sale, and retention of investment securities, including recalibrations for fair value.

Related questions

At December 31 2017 the Trading Securities Portfolio Held by ...

On January 1 Oetry Corporation Purchased a 35% Equity in ...

The Following Transactions Were Made by Allen Company ...

Maxim Corporation Had the Following Transactions Pertaining to Debt Investments ...

Terra Cotta Company Has the Following Data at December 31 ...