Asked by Lizbeilyn Ozoria on May 17, 2024

Verified

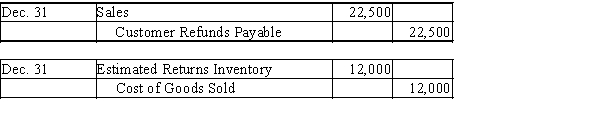

Stergell Company had sales of $1,500,000 and related cost of goods sold of $920,000 for the year. Stergell estimates that customers will request refunds for 1.5% of sales and estimates that merchandise costing $12,000 will be returned. Journalize the adjusting entries on December 31 to record the expected customer returns.

Adjusting Entries

Journal entries made at the end of an accounting period to record revenues to the period they are earned and expenses to the period incurred.

Cost of Goods Sold

The expenses directly associated with the manufacturing of products a company sells, such as materials and labor.

Customer Returns

Goods or merchandise sent back to the retailer or manufacturer by the purchaser due to defects, dissatisfaction, or other reasons.

- Journalize adjusting entries for inventory and expected customer returns and allowances.

Verified Answer

MR

Learning Objectives

- Journalize adjusting entries for inventory and expected customer returns and allowances.