Asked by jasmine badayos on Jul 08, 2024

Verified

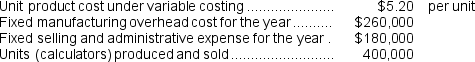

Shun Corporation manufactures and sells a hand held calculator.The following information relates to Shun's operations for last year:  What is Shun's absorption costing unit product cost for last year?

What is Shun's absorption costing unit product cost for last year?

A) $4.10 per unit

B) $4.55 per unit

C) $5.85 per unit

D) $6.30 per unit

Absorption Costing

This accounting technique combines all costs associated with manufacturing, such as materials directly used, labor directly applied, and all categories of overhead, fixed or variable, in determining a product’s cost.

Unit Product Cost

The total cost (both direct and indirect) assigned to a single unit of product.

- Identify the factors that contribute to the unit product cost in both variable and absorption costing contexts.

Verified Answer

KP

Kaitie PerinJul 10, 2024

Final Answer :

C

Explanation :

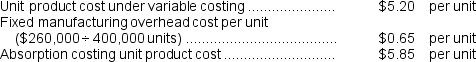

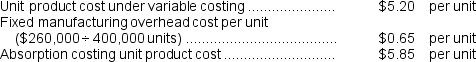

To calculate the absorption costing unit product cost, we need to add up all the manufacturing costs per unit:

Direct materials per unit: $1.10

Direct labor per unit: $0.75

Variable manufacturing overhead per unit: $0.70

Fixed manufacturing overhead per unit: $3.30 ($1,650,000/500,000 units)

Total absorption costing unit product cost: $5.85 per unit

Direct materials per unit: $1.10

Direct labor per unit: $0.75

Variable manufacturing overhead per unit: $0.70

Fixed manufacturing overhead per unit: $3.30 ($1,650,000/500,000 units)

Total absorption costing unit product cost: $5.85 per unit

Explanation :

Learning Objectives

- Identify the factors that contribute to the unit product cost in both variable and absorption costing contexts.

Related questions

Mullee Corporation Produces a Single Product and Has the Following ...

The Unit Product Cost Under Absorption Costing in Year 1 ...

The Unit Product Cost Under Variable Costing in Year 1 ...

A Cost That Would Be Included in Product Costs Under ...

Assuming That Direct Labor Is a Variable Cost, the Primary ...