Asked by Annie Vatterott on Apr 29, 2024

Verified

Shallot Company has the following data at December 31 2017 for its securities. Securities ‾ Cost ‾ Fair Value ‾ Trading $90,000$93,000 Available-for-sale 74,00068,000\begin{array} { l r r } \underline{\text { Securities }} & \underline { \text { Cost } } & \underline{ \text { Fair Value } } \\\text { Trading } & \$ 90,000 &\$93,000\\\text { Available-for-sale }&74,000&68,000\end{array} Securities Trading Available-for-sale Cost $90,00074,000 Fair Value $93,00068,000 Instructions

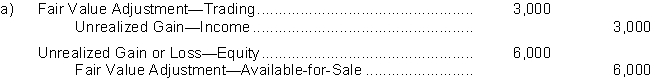

(a) Prepare the adjusting entries to report the securities at fair value.

(b) Indicate the statement presentation of the related unrealized gain (loss) accounts for each class of securities.

Securities

Financial instruments representing ownership (stocks), a debt agreement (bonds), or the rights to ownership (derivatives).

Fair Value

An estimated market value of an asset or liability, reflecting current market conditions rather than historical cost, used in financial reporting.

Adjusting Entries

Journal entries made at the end of an accounting period to allocate income and expenses to the period in which they actually occurred.

- Set up and revise accounting entries to present investments at fair value following the rules of Generally Accepted Accounting Principles.

- Determine the representation of investment activities on the income statement and balance sheet and understand their implications.

- Gain insight into the procedures for managing unrealized gains and losses on securities designated as available for sale.

Verified Answer

(b) Unrealized Gain-Income: Income Statement under other revenues and gains

(b) Unrealized Gain-Income: Income Statement under other revenues and gainsUnrealized Gain or Loss-Equity: Balance Sheet as part of stockholders' equity

Learning Objectives

- Set up and revise accounting entries to present investments at fair value following the rules of Generally Accepted Accounting Principles.

- Determine the representation of investment activities on the income statement and balance sheet and understand their implications.

- Gain insight into the procedures for managing unrealized gains and losses on securities designated as available for sale.

Related questions

On January 1 2017 Mink Company Purchased 5000 Shares of ...

Rosco Company Purchased 35000 Shares of Common Stock of Paxton ...

Plotner Corporation Has the Following Trading Portfolio of Stock Investments ...

An Unrealized Gain or Loss on Available-For-Sale Securities Is Reported ...

Fair Value Adjustment Is a Valuation _______________ Account Which Is ...