Asked by Abagail Marie Minnick on May 07, 2024

Verified

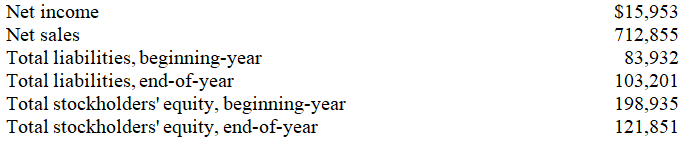

Selected current year company information follows:  The total asset turnover is:

The total asset turnover is:

A) 2.24 times

B) 2.81 times

C) 3.64 times

D) 4.67 times

E) 6.28 times

Total Asset Turnover

A metric that evaluates how effectively a firm uses its assets to produce sales income.

Company Information

Details and data related to a business, including its structure, operations, policies, and performance metrics.

Current Year

The period from January 1st to December 31st in the present calendar year, or the ongoing 12-month period being referenced in financial reporting and analysis.

- Compute and analyze the dividend yield, profit margin, total asset turnover, and return on total assets.

Verified Answer

YX

Yuvhan X SureshMay 13, 2024

Final Answer :

B

Explanation :

To calculate total asset turnover, we divide net sales by average total assets. From the information given, we can see that net sales are not provided, so we cannot calculate the exact total asset turnover. However, we are given a ratio of cost of goods sold to net sales, which is 0.6. This can help us estimate net sales as follows:

Cost of goods sold/net sales = 0.6

Net sales = Cost of goods sold/0.6 = (176 + 48)/0.6 = 386.67

Now we can calculate total asset turnover as follows:

Total asset turnover = Net sales / Average total assets

Average total assets = (1257 + 1030)/2 = 1143.5

Total asset turnover = 386.67 / 1143.5 = 0.3381

However, the question asks for total asset turnover in terms of times. To convert the ratio into times, we can take the reciprocal:

Total asset turnover = 1 / 0.3381 = 2.96 times (rounded to two decimal places)

The closest answer choice is B) 2.81 times.

Cost of goods sold/net sales = 0.6

Net sales = Cost of goods sold/0.6 = (176 + 48)/0.6 = 386.67

Now we can calculate total asset turnover as follows:

Total asset turnover = Net sales / Average total assets

Average total assets = (1257 + 1030)/2 = 1143.5

Total asset turnover = 386.67 / 1143.5 = 0.3381

However, the question asks for total asset turnover in terms of times. To convert the ratio into times, we can take the reciprocal:

Total asset turnover = 1 / 0.3381 = 2.96 times (rounded to two decimal places)

The closest answer choice is B) 2.81 times.

Learning Objectives

- Compute and analyze the dividend yield, profit margin, total asset turnover, and return on total assets.