Asked by Caitlin White on May 04, 2024

Verified

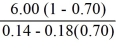

Rose Hill Trading Company is expected to have EPS in the upcoming year of $6. The expected ROE is 18%. An appropriate required return on the stock is 14%. If the firm has a plowback ratio of 70%, its intrinsic value should be ________.

A) $20.93

B) $69.77

C) $128.57

D) $150

Plowback Ratio

The proportion of earnings retained by a company after dividends have been paid out, often used to fund growth projects.

Intrinsic Value

The actual, underlying worth of an asset, investment, or company based on fundamental analysis without regard to its market value.

ROE

Return on Equity, a financial ratio indicating the profitability of a company relative to its shareholders' equity.

- Understand how to apply the Dividend Discount Model (DDM) to determine the intrinsic value of a stock.

- Understand the role and calculation of the plowback (earnings retention) ratio in growth and valuation.

- Apply the Constant-Growth DDM to estimate stock value in a constant growth scenario.

Verified Answer

ZK

Learning Objectives

- Understand how to apply the Dividend Discount Model (DDM) to determine the intrinsic value of a stock.

- Understand the role and calculation of the plowback (earnings retention) ratio in growth and valuation.

- Apply the Constant-Growth DDM to estimate stock value in a constant growth scenario.

= 128.57

= 128.57